Understanding how paychecks are calculated is crucial for both employees and employers. Accurate paycheck calculations ensure fair compensation and compliance with labor laws. This blog will explore the various factors involved in paycheck calculations, including gross pay, deductions, and net pay. Additionally, we’ll discuss how a free pay stub generator can streamline this process and help maintain accurate financial records.

Understanding Paycheck Calculation

The process of calculating paychecks involves several steps, from determining gross income to applying various deductions to arrive at the net pay. Here’s a detailed breakdown of how paychecks are calculated:

1. Determining Gross Pay

Gross pay is the total amount earned by an employee before any deductions are applied. It includes base salary or hourly wages, overtime pay, bonuses, commissions, and any other forms of compensation.

a. Base Salary or Hourly Wages

- Salaried Employees: For employees on a fixed salary, the gross pay is calculated by dividing the annual salary by the number of pay periods in a year (e.g., 12 for monthly paychecks).

Example: An employee with an annual salary of $60,000 would have a gross monthly pay of $5,000.

- Hourly Employees: For hourly workers, gross pay is calculated by multiplying the number of hours worked by the hourly wage. Overtime hours are paid at a higher rate, typically 1.5 times the regular hourly rate.

Example: An employee working 160 hours at a $20 hourly rate would have a gross pay of $3,200. If they worked 10 overtime hours at $30 per hour, their total gross pay would be $3,800.

b. Bonuses and Commissions

- Bonuses: Performance bonuses, holiday bonuses, or signing bonuses are added to the gross pay. They are typically calculated based on company performance or individual achievements.

Example: A $500 bonus added to the gross pay increases the total earnings.

- Commissions: Sales commissions are earned based on the revenue generated by the employee. Commissions are added to the gross pay based on the agreed percentage or amount.

Example: A 5% commission on $10,000 in sales amounts to a $500 commission.

2. Calculating Deductions

Deductions are amounts subtracted from the gross pay to determine the net pay. These can be categorized into mandatory and voluntary deductions.

a. Mandatory Deductions

- Federal Income Tax: Withheld based on the employee’s tax bracket and allowances claimed on their W-4 form. The IRS provides tax tables to help employers calculate the correct amount.

- State Income Tax: Varies by state and is withheld according to state-specific tax rates and regulations.

- Social Security Tax: Withheld at a rate of 6.2% up to the annual wage limit ($160,200 for 2023).

- Medicare Tax: Withheld at a rate of 1.45% on all earnings. An additional 0.9% Medicare tax applies to high earners.

b. Voluntary Deductions

- Health Insurance Premiums: Amounts withheld for employee health insurance plans, which may include individual or family coverage.

- Retirement Contributions: Contributions to retirement plans such as 401(k) or 403(b) are deducted based on employee elections.

- Other Benefits: Deductions for additional benefits such as life insurance, disability insurance, or flexible spending accounts (FSAs).

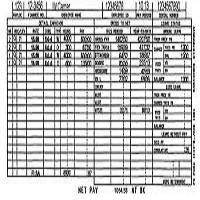

3. Calculating Net Pay

Net pay is the amount an employee takes home after all deductions are applied. It is calculated by subtracting total deductions from the gross pay.

Formula:

Net Pay=Gross Pay−Total Deductions\text{Net Pay} = \text{Gross Pay} – \text{Total Deductions}Net Pay=Gross Pay−Total Deductions

Example:

If an employee’s gross pay is $5,000, and their total deductions (including taxes, health insurance, and retirement contributions) amount to $1,200, their net pay would be $3,800.

4. Paycheck Periods

Paychecks can be issued on different schedules, including:

- Weekly: Paychecks are issued every week.

- Biweekly: Paychecks are issued every two weeks.

- Semimonthly: Paychecks are issued twice a month.

- Monthly: Paychecks are issued once a month.

The paycheck period affects the calculation of gross pay and deductions. For example, employees on a monthly payroll receive a larger paycheck compared to those on a biweekly payroll, assuming the same annual salary.

Using a Free Pay Stub Generator

A free pay stub generator is a valuable tool for calculating and generating accurate pay stubs. Here’s how it can assist in the paycheck calculation process:

1. Simplifying Calculations

A free pay stub generator automates the calculation of gross pay, deductions, and net pay. By entering basic information, the tool performs the calculations and generates a professional pay stub.

2. Ensuring Accuracy

Automated tools reduce the risk of errors in paycheck calculations. They use up-to-date tax tables and deduction rates to ensure accurate calculations, reducing the likelihood of mistakes.

3. Providing Professional Documentation

A pay stub generator creates clear and professional pay stubs that include all necessary details, such as employee information, earnings, deductions, and net pay. This documentation is useful for employees and employers alike.

4. Streamlining Payroll Management

Using a pay stub generator streamlines the payroll process by automating repetitive tasks. It saves time and effort compared to manual calculations and ensures consistency in paycheck documentation.

How to Use a Free Pay Stub Generator

Using a free pay stub generator involves a few simple steps:

1. Select a Reliable Tool

Choose a reputable free pay stub generator with positive reviews and essential features. Ensure that the tool offers accurate calculations and professional templates.

2. Enter Employee Information

Input employee details, including name, address, and employee ID. This information will appear on the generated pay stub.

3. Enter Pay Information

Input the relevant pay details, such as the pay period, gross earnings, and any bonuses or commissions. The generator will calculate the gross pay based on this information.

4. Input Deductions

Enter details for mandatory and voluntary deductions, including taxes, health insurance, and retirement contributions. The generator will automatically subtract these deductions from the gross pay.

5. Review and Generate

Review the entered information for accuracy. Once satisfied, generate the pay stub. The tool will provide a professional document that includes all relevant details.

6. Distribute and Store

Distribute the pay stubs to employees and keep copies for your records. Ensure that all information is accurate and up-to-date for future reference.

Challenges in Paycheck Calculation

Accurate paycheck calculation can present several challenges:

1. Tax Code Changes

Tax laws and rates can change frequently, affecting paycheck calculations. Staying updated with current tax regulations is essential for accurate calculations.

2. Complex Deductions

Handling complex deductions, such as multiple benefits or varying retirement contributions, can be challenging. A pay stub generator can help manage these complexities.

3. Time Constraints

Payroll management can be time-consuming, especially for businesses with many employees. Using a pay stub generator helps save time and streamline the process.

Conclusion

Calculating paychecks involves determining gross pay, applying deductions, and arriving at net pay. Understanding these components ensures fair and accurate compensation for employees.

A free pay stub generator can simplify the paycheck calculation process, providing accurate and professional pay stubs while saving time and reducing errors. By leveraging these tools, businesses can streamline payroll management and ensure transparency and fairness in employee compensation.

Whether you’re an employee seeking clarity on your pay or an employer managing payroll, understanding paycheck calculations and utilizing a pay stub generator will enhance financial accuracy and efficiency.