In today’s gig economy, many workers are freelancers or contractors. Whether you’re a rideshare driver, a graphic designer, or a freelance writer, having proper documentation of your income is crucial. One important document you might need is a pay stub. A pay stub, or paycheck stub, is a record that shows your earnings and deductions for a specific pay period. It can be essential for applying for loans, renting an apartment, or even for tax purposes. But when it comes to creating a pay stub, should you do it yourself using a paystub creator, or should you hire a professional? Let’s dive into the pros and cons of both options.

What is a Paystub Creator?

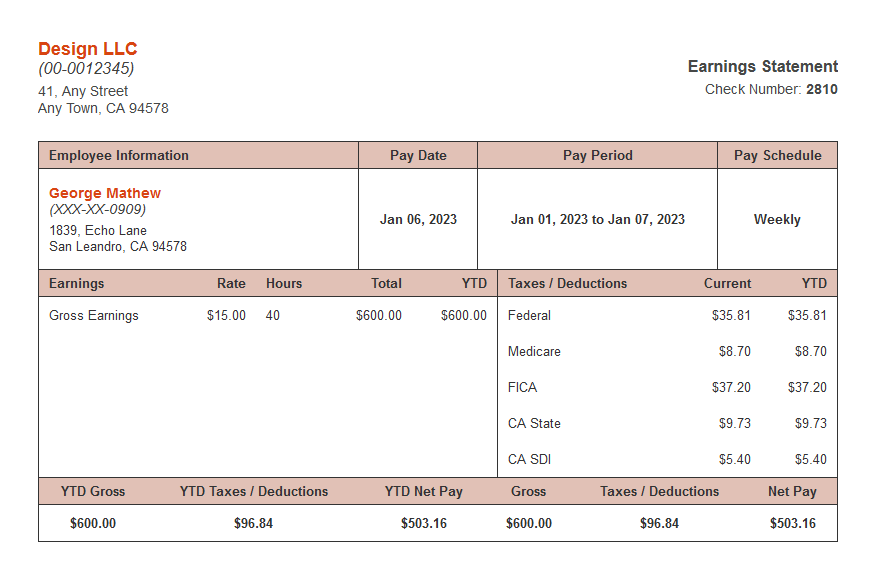

A paystub creator is an online tool or software that helps you generate pay stubs quickly and easily. Most paystub creators come with templates that allow you to input your income details, deductions, and any other necessary information. Once you fill in the required fields, the software generates a professional-looking pay stub that you can print or save as a PDF.

Key Features of Paystub Creators

-

User-Friendly Interface: Most paystub creators are designed to be easy to use, even if you don’t have much experience with software.

-

Customization Options: You can often customize the pay stub to include your company’s logo and other relevant details.

-

Quick Turnaround: Most paystub creators generate a pay stub within minutes, saving you time.

-

Affordability: Many paystub creators are available for a low fee or even for free, making them an accessible option for most people.

DIY Paystub Creation

Creating your own pay stub using a paystub creator can be appealing for various reasons:

Benefits of DIY

-

Cost-Effective: Using a paystub creator is usually cheaper than hiring a professional. If you only need a pay stub occasionally, this option can save you money.

-

Control Over Information: When you create your own pay stub, you have complete control over the information included. You can add specific details that reflect your earnings and deductions accurately.

-

Learning Experience: Using a paystub creator can be a great way to learn more about your earnings, taxes, and deductions. This knowledge can be beneficial when managing your finances.

Drawbacks of DIY

-

Lack of Expertise: If you’re not familiar with payroll, you may make mistakes when entering information. Errors in your pay stub can lead to issues down the line, especially if it’s used for loan applications or other financial purposes.

-

Limited Support: When you create a pay stub yourself, you may not have access to professional support if you run into issues or have questions.

-

Potential for Legal Issues: If you accidentally create a pay stub that doesn’t comply with legal requirements, you could face penalties or issues in the future.

Professional Paystub Services

Hiring a professional service to create your pay stub may also be an option to consider. Let’s take a look at the benefits and drawbacks.

Benefits of Professional Services

-

Expertise: Professionals who specialize in payroll know the ins and outs of pay stub creation. They understand what needs to be included and can help ensure your pay stub is accurate and compliant.

-

Time-Saving: If you’re busy, hiring a professional can save you time and effort. You provide them with your details, and they handle the rest.

-

Reliability: A professional service is likely to provide you with a pay stub that meets all legal and financial standards, reducing the risk of errors.

Drawbacks of Professional Services

-

Cost: Professional services can be more expensive than using a paystub creator. If you only need a pay stub occasionally, this cost may not be justified.

-

Less Control: When you hire someone else to create your pay stub, you may have less control over the information included. This can be a disadvantage if you want specific details highlighted.

-

Turnaround Time: Depending on the service, getting your pay stub might take longer than using a DIY option. If you need it urgently, this could be a significant drawback.

When to Use a Paystub Creator

Ideal Situations for DIY

-

Freelancers and Gig Workers: If you’re a freelancer or gig worker who receives income sporadically, using a paystub creator can help you document your earnings without the need for a professional service.

-

Simple Pay Structures: If your pay structure is straightforward and doesn’t involve complex deductions, a DIY pay stub may be sufficient.

-

Budget Constraints: If you’re looking to save money and only need a pay stub occasionally, a paystub creator can be a cost-effective solution.

Ideal Situations for Professional Services

-

Complex Income Situations: If your income involves various deductions, bonuses, or commissions, a professional can help ensure everything is accurately reflected.

-

Ongoing Employment: For those in more traditional jobs with regular paychecks, a professional service might provide the reliability and compliance you need.

-

Financial Institutions: If you need to present pay stubs to banks or lenders, especially for loans or mortgages, opting for a professional service can add an extra layer of credibility.

Tips for Using a Paystub Creator

If you decide to go the DIY route, here are some tips to help you get the best results:

-

Choose a Reputable Creator: Make sure to use a paystub creator that is well-reviewed and trusted by other users. Look for recommendations online.

-

Gather Your Information: Before starting, gather all necessary information, including your hourly rate, number of hours worked, deductions, and any bonuses.

-

Double-Check Your Entries: Always review your information before finalizing the pay stub. Look for any errors or missing details.

-

Know Your State Laws: Different states have different laws regarding pay stubs. Familiarize yourself with your state’s requirements to ensure compliance.

-

Save Your Paystubs: Keep copies of your pay stubs for your records. This will be helpful for future reference, especially during tax season.

Conclusion

Deciding whether to use a paystub creator or hire a professional service depends on your individual needs and circumstances. If you’re a freelancer with simple income, a DIY approach using a paystub creator can be cost-effective and efficient. On the other hand, if your financial situation is more complex, or if you need guaranteed compliance, opting for professional help might be the best route.

Regardless of which option you choose, understanding the importance of pay stubs and ensuring they are accurate can greatly benefit your financial standing. In the end, it’s all about making the choice that aligns with your needs, budget, and comfort level. Whether you go DIY or professional, being informed will help you make the right decision for your situation.