Paycheck stubs are an important part of the paycheck process that many workers encounter regularly. Whether you’re a full-time employee, part-time worker, or even a freelancer, understanding your paycheck stub can help you keep track of your earnings and ensure you’re being paid correctly. In this blog, we’ll explore what paycheck stubs are, the information they provide, and why they matter. We’ll also discuss how you can create a paycheck stub using a free check stub maker.

What is a Paycheck Stub?

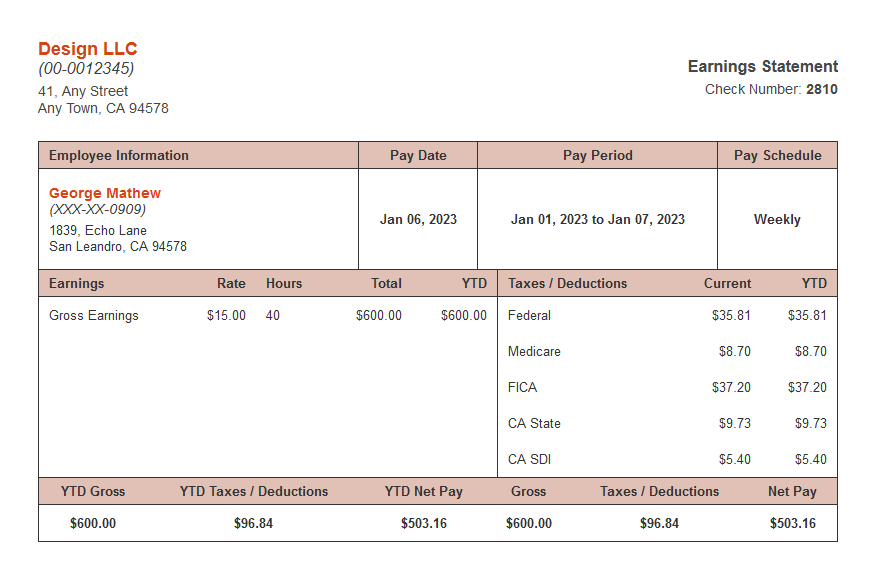

A paycheck stub, sometimes called a pay stub or pay slip, is a document that accompanies your paycheck. It details how much you earned during a specific pay period and provides a breakdown of deductions and other important information. Paycheck stubs can be printed or provided electronically, depending on the employer’s practices.

Why Paycheck Stubs Matter

- Verification of Earnings: Paycheck stubs allow you to verify your earnings and ensure that you are being paid correctly for your work.

- Budgeting: Knowing how much you earn helps you plan your budget. You can see your net pay, which is the amount you take home after taxes and deductions.

- Loan Applications: If you need to apply for a loan or mortgage, lenders often require proof of income. Paycheck stubs serve as official documentation of your earnings.

- Tax Purposes: Paycheck stubs can help you track your earnings throughout the year, making tax time easier. You can use them to ensure that your reported income matches what your employer has reported to the IRS.

Key Information on Paycheck Stubs

Understanding the different sections of a paycheck stub is crucial. Here’s a breakdown of the information typically included:

1. Employee Information

This section contains your name, address, and employee ID (if applicable). It helps identify whose paycheck stub it is.

2. Employer Information

Your employer’s name and address are listed here. This is important for record-keeping and for any tax-related issues.

3. Pay Period

The pay period indicates the timeframe for which you are being paid. This could be weekly, bi-weekly, or monthly, depending on your employer’s pay schedule.

4. Gross Pay

Gross pay is the total amount you earned before any deductions. It includes your hourly wages or salary, as well as any overtime, bonuses, or commissions you may have earned during the pay period.

5. Deductions

Deductions are amounts taken out of your gross pay. These can include:

- Federal Taxes: Money withheld for federal income tax.

- State Taxes: If you live in a state with income tax, this amount will be deducted.

- Social Security and Medicare: These are mandatory deductions for social security and Medicare, which fund retirement and healthcare for eligible citizens.

- Health Insurance Premiums: If you have health insurance through your employer, your portion of the premium will be deducted.

- Retirement Contributions: Contributions to retirement accounts, like a 401(k), are also taken out before you receive your net pay.

6. Net Pay

Net pay is the amount you take home after all deductions have been made. This is the figure you’ll want to focus on for your budgeting and financial planning.

7. Year-to-Date (YTD) Totals

YTD totals show how much you’ve earned and how much has been deducted for the year so far. This can help you keep track of your overall earnings and deductions as the year progresses.

8. Additional Information

Some paycheck stubs may also include information like:

- Hours Worked: For hourly employees, the total number of hours worked during the pay period.

- Leave Balances: Information on accrued sick leave or vacation days.

- Notes: Any additional notes from your employer regarding changes in pay or policy.

How to Read a Paycheck Stub

Reading a paycheck stub may seem complicated at first, but it becomes easier once you know what to look for. Here’s a step-by-step guide:

- Check Your Personal Information: Ensure that your name and address are correct.

- Review the Pay Period: Confirm the dates of the pay period and the date of payment.

- Look at Your Earnings: Compare the gross pay to what you expect based on your salary or hourly rate.

- Analyze Deductions: Go through each deduction to ensure accuracy. If you see any discrepancies, bring them up with your employer.

- Check Your Net Pay: Make sure the amount you take home aligns with your expectations.

- Examine YTD Totals: Keep an eye on how your earnings and deductions accumulate over the year.

What to Do if You Spot an Error

If you find an error on your paycheck stub, it’s important to act quickly. Here’s what you can do:

- Gather Evidence: Collect any relevant documents, such as your employment contract or previous pay stubs.

- Speak to Your Employer: Approach your HR department or supervisor to discuss the issue. Bring your evidence and be clear about the discrepancy.

- Follow Up: If the issue isn’t resolved, make sure to follow up until it is corrected.

Free Check Stub Maker

If you are self-employed or work as a freelancer, you may need to create your own paycheck stubs. Fortunately, there are many free check stub makers available online. Here’s how they work:

Benefits of Using a Free Check Stub Maker

- Easy to Use: Most free check stub makers have user-friendly interfaces that allow you to input your information quickly.

- Customizable: You can tailor the stub to fit your specific needs, including adding your business name and logo.

- Printable: Once you’ve created your stub, you can easily print it out or save it as a PDF.

How to Use a Free Check Stub Maker

- Choose a Reliable Website: Look for a free check stub maker that has good reviews and is easy to navigate.

- Input Your Information: Enter your name, your employer’s information, and your earnings details.

- Add Deductions: Include any deductions such as taxes or health insurance.

- Generate the Stub: Once you’ve filled in all the necessary fields, generate your paycheck stub.

- Download or Print: Save the document as a PDF or print it for your records.

Conclusion

Paycheck stubs are more than just a piece of paper; they are vital tools for understanding your earnings and managing your finances. By knowing how to read and interpret your paycheck stub, you can ensure you’re being paid correctly and keep track of your financial health.

If you’re a freelancer or self-employed, using a free check stub maker can help you generate professional-looking pay stubs that can assist with budgeting and tax purposes.

Being informed about your paycheck stub empowers you as an employee and helps you take control of your financial future. Always review your stubs carefully, and don’t hesitate to reach out to your employer if you spot any discrepancies. Your financial well-being depends on it!