Creating pay stubs has become increasingly important for individuals and businesses alike. Whether you’re a freelancer, small business owner, or employee, accurate pay stubs can help you manage finances, apply for loans, and maintain transparency in your earnings. Using a free pay stub maker can save you time and money, but it’s essential to avoid common pitfalls that could lead to errors or misunderstandings. In this blog, we’ll explore the typical mistakes people make when using these tools and provide tips to ensure your check stubs are accurate and professional.

1. Not Understanding the Purpose of Pay Stubs

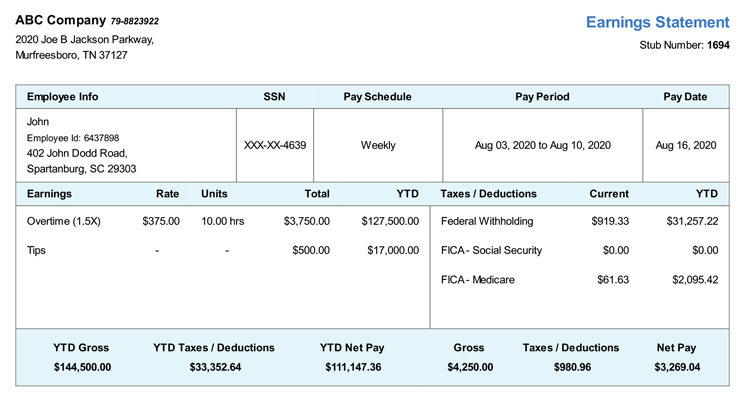

Before diving into creating pay stubs, it’s crucial to understand their purpose. Pay stubs are legal documents that detail an employee’s earnings for a specific pay period, including gross pay, deductions, and net pay. They serve various purposes:

- Loan Applications: Banks and lenders often require pay stubs to verify income.

- Tax Filing: Pay stubs can help when filing taxes, providing a summary of earnings and deductions.

- Proof of Income: They serve as proof of income when renting an apartment or applying for government assistance.

Mistake to Avoid: Make sure you recognize that your pay stub is not just a formality. It’s a critical document that can affect your financial future.

2. Using Inaccurate Information

One of the most common mistakes when creating pay stubs is entering incorrect information. This can include:

- Wrong Names: Double-check that the employee’s name is spelled correctly.

- Incorrect Tax Information: Ensure you enter the right Social Security number and other tax identification numbers.

- Inaccurate Pay Rates: Verify that the hourly rate or salary is correct.

Mistake to Avoid: Always cross-check the information you input. A small mistake can lead to larger issues down the line, particularly when it comes to tax reporting or loan applications.

3. Overlooking Deductions

Deductions can be complex, and it’s easy to overlook them when creating pay stubs. Common deductions include:

- Federal and State Taxes: Different states have various tax rates, and you need to account for these.

- Social Security and Medicare: These are mandatory deductions that need to be included.

- Retirement Contributions: If the employee contributes to a 401(k) or similar plan, this should also be reflected.

Mistake to Avoid: Familiarize yourself with the deductions applicable to your situation. Using an accurate paystub maker should allow you to input these correctly, but it’s your responsibility to ensure they are accurate.

4. Not Including Employer Information

A professional pay stub should include employer details, such as:

- Company Name: Clearly state the name of the business.

- Address: Include the physical address of the company.

- Contact Information: Provide a phone number or email for any follow-up questions.

Mistake to Avoid: Omitting employer information can make the pay stub appear unprofessional and might raise questions during audits or loan applications. Always ensure that this information is included.

5. Choosing the Wrong Template

Free pay stub makers often provide various templates. Choosing the wrong one can lead to confusion or inaccuracies. Consider the following when selecting a template:

- Industry Standard: Certain industries may require specific formats.

- Detail Level: Ensure the template has space for all necessary information, including pay rates, hours worked, and deductions.

Mistake to Avoid: Take time to review different templates. A well-structured template can make the creation process smoother and ensure you don’t miss any crucial details.

6. Failing to Review Before Finalizing

Once you create a pay stub, it’s tempting to hit “print” or “save” without reviewing it first. This can lead to oversights and errors that could have been easily corrected.

Mistake to Avoid: Always take the time to review the pay stub before finalizing it. Look for:

- Spelling Errors: Check for typos in names, addresses, and figures.

- Mathematical Errors: Ensure that calculations for gross pay, deductions, and net pay are correct.

7. Not Keeping Records

Once you’ve created a pay stub, it’s crucial to keep a copy for your records. This serves multiple purposes:

- Tax Filing: You may need these records for future tax filings.

- Financial Planning: Keeping track of your earnings helps you budget better.

- Proof of Income: In case you need to provide proof of income for loans or other financial applications.

Mistake to Avoid: Always save a copy of each pay stub you create. Digital storage solutions can help you organize and easily retrieve these documents when needed.

8. Ignoring State-Specific Regulations

Each state in the U.S. has its own laws regarding pay stubs. Some states require specific information to be included, while others may have regulations on how often pay stubs should be issued.

Mistake to Avoid: Familiarize yourself with your state’s requirements for pay stubs. Ignoring these can lead to legal issues or complications for both employers and employees.

9. Using Outdated Software

As technology evolves, pay stub makers are updated to comply with the latest tax laws and regulations. Using outdated software may lead to incorrect calculations or missing features.

Mistake to Avoid: Always use the latest version of any software or online tool. This ensures you have access to the most current features and tax rates.

10. Relying Solely on Free Tools

While free pay stub makers can be convenient, they may lack features that paid versions offer. These features could include:

- Customization Options: Paid versions may allow for more personalized pay stubs.

- Customer Support: With free tools, support options may be limited.

- Compliance Updates: Paid services often stay updated with changes in tax laws.

Mistake to Avoid: Evaluate whether a paid service might be worth the investment for your needs. If you regularly create pay stubs or require specific features, it may save you time and hassle in the long run.

11. Underestimating the Importance of Design

While the content of a pay stub is crucial, the design should not be overlooked. A professional-looking pay stub can instill confidence and convey a sense of legitimacy. Key design elements include:

- Clear Fonts: Use legible fonts that are easy to read.

- Logical Layout: Organize information in a way that flows naturally.

- Branding: If you’re a business, include your logo to enhance credibility.

Mistake to Avoid: Pay attention to how your pay stub looks. A clean and professional design can make a significant difference.

12. Neglecting Employee Consent

If you’re creating pay stubs for employees, it’s essential to ensure they are aware of how their information will be used and shared. This is particularly important in terms of privacy and confidentiality.

Mistake to Avoid: Always communicate with employees about how their information will be handled. Transparency helps build trust and avoids potential disputes.

Conclusion

Creating accurate and professional pay stubs is essential for both employees and employers. By avoiding common mistakes like using inaccurate information, overlooking deductions, and neglecting to review your pay stub, you can ensure that your check stubs are reliable and serve their intended purpose.

Investing the time to understand the components of a pay stub, familiarize yourself with your state’s requirements, and use reputable tools will lead to smoother financial processes. Remember, a well-crafted pay stub is not just a piece of paper; it’s a vital document that can influence your financial decisions.

Whether you’re creating pay stubs for yourself or your employees, keep these common mistakes in mind and take the necessary steps to avoid them. This way, you can manage your finances effectively and maintain professionalism in your documentation.