Managing payroll can be one of the more challenging aspects of running a business. For many business owners and decision-makers, ensuring that employees are paid accurately and on time is crucial for maintaining morale and compliance with labor laws. However, mistakes can happen, and adjustments or corrections may be necessary from time to time. This is where a check stub maker becomes an invaluable tool. In this blog, we’ll explore how using a check stub maker can help you track payroll adjustments and corrections effectively.

Understanding the Importance of Payroll Accuracy

Before we delve into the specifics of how a check stub maker can assist with payroll adjustments, let’s take a moment to discuss why payroll accuracy is so vital.

-

Employee Trust: Employees rely on timely and accurate payments for their livelihoods. If mistakes occur frequently, it can erode trust in management and affect overall employee satisfaction.

-

Legal Compliance: Inaccurate payroll can lead to violations of labor laws, resulting in penalties and potential lawsuits. Keeping precise records ensures compliance with federal and state regulations.

-

Financial Health: For business owners, incorrect payroll can affect cash flow and financial planning. Understanding labor costs accurately is essential for budgeting and forecasting.

-

Administrative Efficiency: Streamlining payroll processes can save time and reduce the administrative burden on HR staff. An efficient system helps ensure that all payroll adjustments are made promptly.

What is a Check Stub Maker?

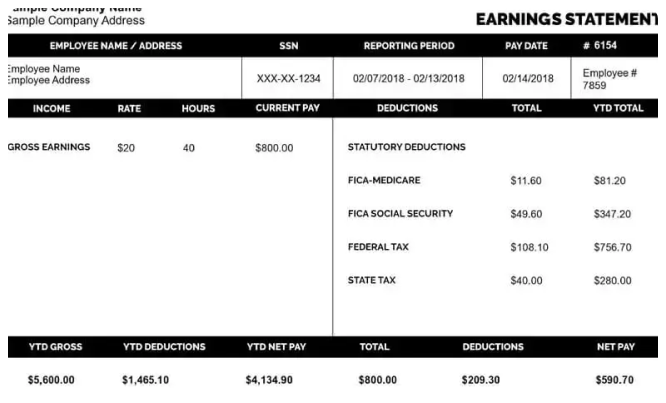

A check stub maker is a digital tool designed to create professional pay stubs for employees. These tools are user-friendly and allow you to generate pay stubs quickly and accurately. Most check stub makers require you to enter specific details such as employee names, pay periods, gross wages, deductions, and net pay.

The generated pay stubs provide employees with a clear breakdown of their earnings and deductions, making it easy for them to understand how their pay is calculated.

How a Check Stub Maker Helps Track Payroll Adjustments

1. Simplifying Record-Keeping

When payroll adjustments are necessary—whether due to overtime, errors, or other reasons—a check stub maker simplifies record-keeping. Instead of manually writing new pay stubs for each adjustment, you can create updated stubs in just a few clicks. This digital record helps ensure that every adjustment is documented and easily accessible, which can be especially helpful during audits.

2. Accurate Deductions and Adjustments

Payroll adjustments often involve changes in deductions, whether for taxes, benefits, or other employee contributions. A check stub maker helps ensure that these adjustments are accurately reflected. By entering the correct figures, the software calculates the new net pay automatically, reducing the risk of human error.

For example, if an employee needs to adjust their 401(k) contributions, entering the new amount into the check stub maker will automatically update the employee’s pay stub, ensuring that both the employer and employee have the most accurate information.

3. Employee Access to Real-Time Information

Most modern check stub makers offer features that allow employees to access their pay stubs online. This means employees can check their earnings, deductions, and any adjustments made to their pay in real time. Transparency fosters trust and allows employees to address any discrepancies as soon as they arise.

If an employee notices a discrepancy, they can bring it to management’s attention immediately. This proactive communication helps resolve issues before they escalate, creating a healthier workplace dynamic.

4. Customizable Templates

Every business has different needs when it comes to payroll. A good check stub maker offers customizable templates, allowing you to tailor the stubs to fit your brand and requirements. This includes adjusting the layout, adding your company logo, and selecting the specific information you want to display.

Custom templates can be especially useful when tracking payroll adjustments. You can create different versions of pay stubs that highlight specific changes, making it easier for both management and employees to recognize adjustments.

5. Reducing Errors and Overpayment

One of the significant benefits of using a check stub maker is the reduction of errors in payroll calculations. Manual calculations are prone to mistakes, leading to overpayments or underpayments. The automated nature of check stub makers minimizes the chance of errors, ensuring that employees receive the correct amount each pay period.

In cases where adjustments need to be made, having a reliable check stub maker allows for quick corrections. You can revise pay stubs to reflect any necessary changes, preventing ongoing issues from compounding.

6. Detailed Reporting

Many check stub makers include reporting features that allow you to track payroll adjustments over time. This can provide valuable insights into patterns, such as recurring adjustments for specific employees or departments.

Understanding these trends can help you identify potential issues in your payroll processes and address them proactively. For example, if one employee frequently has adjustments, it may be worth reviewing their hours or pay structure to find a more efficient solution.

7. Integration with Accounting Software

A check stub maker can often integrate seamlessly with your existing accounting software. This integration allows for automatic updates between your payroll and accounting systems, reducing the risk of discrepancies.

When payroll adjustments are made, they can be instantly reflected in your accounting records. This level of synchronization helps ensure that financial reports are accurate and up to date, which is crucial for business decision-making.

8. Enhancing Compliance and Audit Preparedness

Accurate payroll records are essential for compliance with labor laws and regulations. A check stub maker helps you maintain comprehensive records of all payroll transactions, including adjustments.

In the event of an audit, having organized, easily accessible pay stubs can streamline the process. Auditors can quickly verify payroll records, making it easier to demonstrate compliance with wage and hour laws.

9. Cost-Effectiveness

Investing in a check stub maker can save your business money in the long run. The time saved in payroll processing and the reduced risk of costly payroll mistakes can outweigh the initial cost of the tool.

Additionally, by ensuring that employees are paid accurately and on time, you can avoid potential penalties associated with non-compliance or labor disputes.

Conclusion

A check stub is more than just a tool for generating pay stubs; it’s a comprehensive solution for managing payroll adjustments and corrections effectively. By streamlining the payroll process, enhancing accuracy, and providing easy access to information, businesses can foster trust with employees while ensuring compliance with labor laws.

For business owners and decision-makers, embracing a check stub maker can lead to more efficient payroll management, ultimately contributing to a positive workplace environment and improved employee satisfaction. If you haven’t yet adopted a check stub maker, consider doing so to enhance your payroll process today.

Remember, accurate payroll isn’t just about numbers—it’s about valuing your employees and fostering a culture of transparency and trust within your organization. With the right tools, managing payroll adjustments becomes a straightforward process that benefits everyone involved.