When it comes to managing your finances, every detail counts. One important document that can help you keep track of your income and expenses is the check stub. Whether you’re an employee receiving a paycheck or a freelancer managing your earnings, understanding the role of check stubs is vital. In this blog, we will explore what check stubs are, why they matter, and how they can aid in your financial journey.

What Are Check Stubs?

A check stub is a small piece of paper that accompanies a paycheck. It provides a detailed breakdown of your earnings and deductions. While it may seem like a simple piece of paper, a check stub serves several important purposes.

Components of a Check Stub

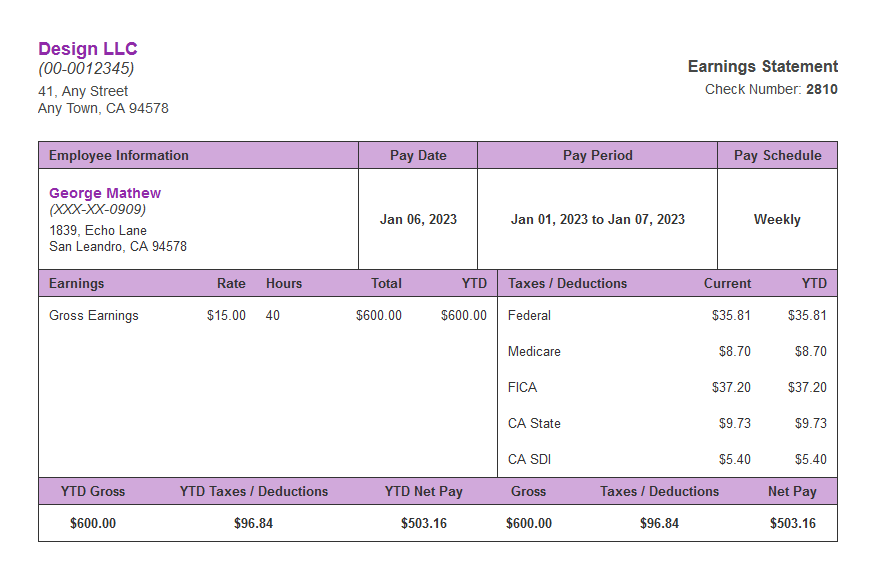

A typical check stub includes the following information:

- Employee Information: Your name, address, and employee ID.

- Employer Information: The name and address of your employer.

- Pay Period: The specific period for which you are being paid.

- Gross Pay: The total amount you earned before any deductions.

- Deductions: Amounts taken out of your paycheck for taxes, health insurance, retirement plans, etc.

- Net Pay: The final amount you take home after all deductions.

Understanding these components can help you track your earnings accurately.

Why Check Stubs Are Important

1. Proof of Income

One of the primary uses of check stubs is as proof of income. Whether you are applying for a loan, renting an apartment, or seeking government assistance, you may need to provide evidence of your earnings. Lenders and landlords often require this information to verify that you can meet your financial obligations.

Check stubs offer a reliable and official record of your income. They are generally more accepted than verbal claims or informal records. Having them on hand can simplify processes like applying for loans or leases.

2. Budgeting and Financial Planning

Effective budgeting is crucial for financial stability. Check stubs provide insight into your income, allowing you to plan your expenses accordingly. By regularly reviewing your check stubs, you can:

- Track Income Trends: Are you earning more than you did last year? Are there seasonal fluctuations? Understanding these patterns can help you adjust your budget.

- Identify Deductions: Knowing how much is being deducted for taxes or benefits allows you to plan for those expenses. You can allocate funds for savings or discretionary spending based on your net income.

- Set Financial Goals: With a clear picture of your income, you can set realistic financial goals. Whether it’s saving for a vacation, a new car, or retirement, understanding your earnings is the first step.

3. Tax Preparation

When tax season rolls around, having your check stubs can simplify the process. They provide a record of your earnings throughout the year, making it easier to report your income accurately. This is especially useful if you have multiple income sources or if your income varies.

Many tax preparers will ask for your check stubs, as they help ensure that you are filing your taxes correctly. By keeping track of your check stubs, you can avoid potential issues with the IRS and make sure you are taking advantage of any deductions or credits you may qualify for.

4. Dispute Resolution

In case of discrepancies in your pay, your check stubs serve as evidence. If you believe you were underpaid or that there were errors in deductions, having your check stubs on hand can help you resolve these issues with your employer.

It’s important to review your check stubs regularly to catch any mistakes early on. If you notice an error, you can address it promptly, rather than waiting until it becomes a larger issue.

5. Financial Accountability

Having a record of your earnings can promote financial accountability. It encourages you to keep track of your income and expenses, leading to better financial habits. By understanding where your money comes from and where it goes, you can make more informed decisions about spending and saving.

6. Retirement Planning

Check stubs often include information about contributions to retirement plans, such as 401(k)s. By reviewing this information, you can ensure you are saving enough for retirement. Many people underestimate how much they need to save, so having clear records can help you stay on track.

7. Supporting Future Employment

If you’re looking for a new job, you may need to provide proof of income from your previous employment. Check stubs can serve as a reliable source of income verification for prospective employers.

8. Freelancers and Gig Workers

For freelancers and gig workers, check stubs can be less straightforward, as you may not receive traditional paychecks. However, keeping detailed records of your income—whether through invoices, receipts, or check stubs—remains essential. These records can help you demonstrate your earnings when applying for loans or managing your taxes.

How to Organize and Keep Track of Check Stubs

Now that you understand the importance of check stubs, it’s essential to know how to organize and keep track of them effectively.

1. Create a Filing System

Set up a physical or digital filing system to store your check stubs. If you prefer physical copies, use folders or binders labeled by year and month. For digital records, consider using a cloud storage service to keep your files organized and easily accessible.

2. Review Regularly

Make it a habit to review your check stubs regularly. This could be monthly or quarterly, depending on your preference. Regular reviews will help you stay on top of your finances and catch any discrepancies early.

3. Use Financial Software

Consider using budgeting software or apps that allow you to input your income and expenses. Many of these tools can also store or link your check stubs, making it easier to track your financial situation.

4. Keep Copies for Tax Season

Before tax season, gather all your check stubs and any other relevant documents. Keeping organized records will make tax preparation smoother and less stressful.

Conclusion

Check stubs are more than just a piece of paper; they are essential tools for financial tracking and proof of income. By understanding their components and importance, you can better manage your finances, prepare for taxes, and achieve your financial goals. Whether you are an employee or a freelancer, taking the time to organize and review your check stubs can lead to improved financial health and peace of mind. So, start keeping track of those check stubs—they could make all the difference in your financial journey!