The education industry is one of the most crucial sectors in any society, but it’s also one that can face unique challenges when it comes to managing finances. Whether you’re a teacher, administrator, or other educational staff, keeping track of payroll can quickly become a complex task. Schools and educational organizations often deal with a wide range of employees, from full-time teachers to part-time tutors, teaching assistants, and administrative staff.

Given the complexities of salaries, hourly wages, contracts, taxes, and benefits, the need for a free paycheck creator has never been more essential. These tools can make managing payroll in educational institutions more efficient, error-free, and affordable. In this blog, we will explore why free paycheck creators are indispensable for payroll in the education industry, how they can benefit educators and administrators alike, and why they should be part of any school’s financial toolkit.

What Is a Free Paycheck Creator?

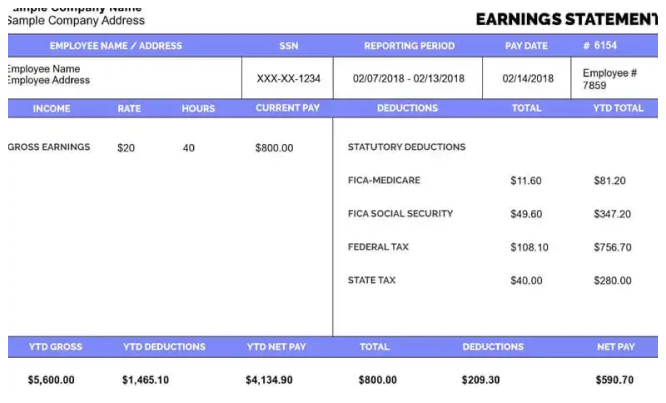

A free paycheck creator is an online tool that helps businesses and organizations generate paychecks for their employees. For educational institutions, this means producing accurate and timely pay stubs for teachers, administrative staff, and other workers. These tools calculate gross pay, deductions (such as taxes and benefits), and net pay, and they can produce pay stubs that employees can either print or access digitally.

Most free paycheck creators are user-friendly, making it easy to input employee details and generate paychecks quickly without needing advanced knowledge of payroll or tax regulations. For education administrators, using a free paycheck creator can save time, reduce errors, and ensure that payroll is processed correctly every month.

Why Are Free Paycheck Creators Essential for the Education Industry?

The education industry has specific payroll needs due to the variety of staff roles and employment types. From teachers with different contract types to part-time tutors and long-term substitutes, the diversity in staff makes managing payroll complex. Here’s why free paycheck creators are particularly useful for educational institutions:

1. Simplifying Complex Payroll Structures

Schools and educational institutions often have diverse staff members, including full-time, part-time, seasonal, and temporary employees. The payroll process can become complicated, especially when staff members are paid on different schedules or receive different types of compensation. Teachers might be salaried, while assistants or tutors may be hourly workers. Some employees may receive bonuses, stipends, or other incentives.

A free paycheck creator can streamline this process by allowing administrators to easily customize payroll for each staff member. You can input hourly rates, salaries, bonuses, and other compensations to generate paychecks that are accurate for every individual’s situation. This eliminates the need for manual calculations and ensures that everyone is paid fairly and on time.

2. Ensuring Compliance with Tax Laws

For educational institutions, staying compliant with tax regulations is crucial. This includes calculating federal, state, and local taxes, as well as contributions to programs like Social Security, Medicare, and unemployment insurance.

A free paycheck creator helps ensure that these tax deductions are automatically calculated and deducted from employee paychecks. These tools are regularly updated to reflect changes in tax laws, so educational institutions don’t have to worry about falling behind on compliance. By using a paycheck creator, schools can avoid costly penalties for tax mistakes and make sure that both employees and the institution are in compliance with all tax regulations.

3. Improving Transparency and Trust

Teachers and staff members work hard, and they deserve to know exactly how their pay is calculated. Transparency in payroll is essential for maintaining trust and morale among employees. Using a free paycheck creator allows administrators to generate detailed pay stubs for every paycheck. These pay stubs clearly show the breakdown of gross pay, deductions, and net pay, ensuring employees understand where their money is coming from and where it’s going.

Providing pay stubs regularly also reduces confusion and ensures that staff members feel confident in the payroll process. It’s an easy way to build trust and show that the school or educational institution takes its payroll responsibilities seriously.

4. Time-Saving Benefits

Managing payroll manually can be extremely time-consuming, especially in educational settings where staff numbers are large and payroll schedules are complex. For administrators who have many other responsibilities to juggle, payroll tasks can become overwhelming. A free paycheck creator automates much of the payroll process, saving significant time and reducing administrative workload.

These tools simplify tasks such as calculating overtime, accounting for sick leave or vacation days, and calculating deductions for taxes and benefits. With a few clicks, you can generate paychecks and pay stubs for all your employees, leaving you with more time to focus on other important tasks.

5. Accuracy and Error Reduction

Manual payroll processing is prone to errors, especially when administrators need to input a lot of data. Mistakes in calculating pay can lead to overpayments, underpayments, or compliance issues. These mistakes not only cause confusion but can also lead to employee dissatisfaction.

A free paycheck creator helps reduce errors by automating calculations and providing a clear, accurate breakdown of payroll. By using a paycheck creator, schools can ensure that employees are paid the correct amount, with all the necessary deductions, and that there are no discrepancies in the payroll process.

6. Keeping Financial Records Organized

Educational institutions must maintain accurate financial records for audits, tax filings, and budgeting purposes. Keeping track of each paycheck, payment dates, tax contributions, and employee benefits is vital for ensuring everything is documented and organized.

A free paycheck creator can help schools stay organized by keeping digital records of every paycheck issued. Many paycheck creators allow you to store past pay stubs and reports, making it easy to access and review financial data whenever needed. Having all payroll records in one place also makes it easier to prepare for tax season or respond to any audit requests.

7. Helping with Budgeting and Financial Planning

Educational institutions, especially public schools, often have tight budgets. Ensuring that funds are allocated appropriately for payroll and other expenses is essential for maintaining financial health. By using a free paycheck creator, administrators can better track payroll expenses and plan for the future.

The detailed payroll reports generated by paycheck creators give administrators a clear picture of how much the school is spending on salaries, benefits, taxes, and other payroll-related costs. This data can be crucial for budgeting, forecasting, and making informed financial decisions.

8. Scalability as Schools Grow

Schools and educational institutions often expand or face fluctuating staffing needs. Whether you’re hiring more teachers, adding new departments, or managing a higher number of part-time staff, the need for an efficient payroll system becomes even more apparent as the school grows. A free paycheck creator can scale with your institution’s needs, allowing you to adjust the system as your payroll structure changes.

Many paycheck creators offer the flexibility to handle an increasing number of employees, varying work hours, or additional benefits as your school expands. With the ability to accommodate growth, the system ensures that payroll remains efficient and accurate no matter how many employees you have.

How to Choose the Best Free Paycheck Creator for the Education Industry

When selecting a free paycheck creator for your educational institution, it’s important to consider the following factors:

- Ease of Use: Choose a tool with an intuitive, user-friendly interface. Schools and administrators often don’t have specialized payroll training, so simplicity is key.

- Customization: Look for a paycheck creator that allows for customization based on different types of employees (full-time, part-time, contractors, etc.). The tool should be flexible enough to handle different pay rates, hours, and benefits.

- Compliance Features: Ensure the tool automatically calculates tax withholdings and keeps up-to-date with federal, state, and local tax regulations.

- Integration: If you use other software (like accounting or HR systems), look for a paycheck creator that integrates with these platforms for seamless workflow.

- Customer Support: Even though the tool should be easy to use, having access to support in case you encounter issues can be invaluable.

Conclusion

Managing payroll in the education industry is no small task, but with the right tools, it can be made easier and more efficient. A free paycheck creator is an essential tool for schools and educational institutions, helping administrators streamline payroll processes, ensure tax compliance, and maintain accurate financial records.

By saving time, reducing errors, and promoting transparency, free paycheck creators help schools ensure that educators and staff members are paid correctly and on time. Whether you’re managing a small private school or a large public district, using a paycheck creator is a smart and cost-effective way to handle payroll. With its numerous benefits, it’s clear that every educational institution could greatly benefit from adopting this essential tool for payroll management.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease