Payroll mistakes can have serious consequences for both employees and businesses. Whether it’s overpaying, underpaying, or failing to apply the correct deductions, these errors can lead to financial losses, legal issues, and employee dissatisfaction. For this reason, many accountants recommend using reliable tools to streamline the payroll process. One such tool is the free paycheck creator, which can help businesses of all sizes avoid payroll mistakes while ensuring accuracy, compliance, and efficiency.

In this blog, we will explore why accountants advocate for using free paycheck creators, the benefits they offer, and how businesses can use them to improve payroll management. We’ll also cover the unique needs of various businesses and industries and explain how free paycheck creators help tackle those challenges.

Why Payroll Accuracy is Critical

Payroll accuracy is essential for several reasons:

- Legal Compliance: Payroll mistakes, such as failing to calculate overtime correctly or not withholding the right amount of taxes, can lead to legal issues. Businesses must comply with both federal and state labor laws to avoid penalties, fines, and potential lawsuits.

- Employee Trust: Employees expect to be paid accurately and on time. Mistakes can lead to frustration, reduced morale, and even high turnover rates. Miscalculating wages, bonuses, or tips can break the trust between employers and employees.

- Financial Stability: Incorrect payroll calculations can affect a company’s cash flow, leading to overspending or delayed payments. Accurate payroll ensures that funds are distributed correctly, which is crucial for maintaining business operations.

What Is a Free Paycheck Creator?

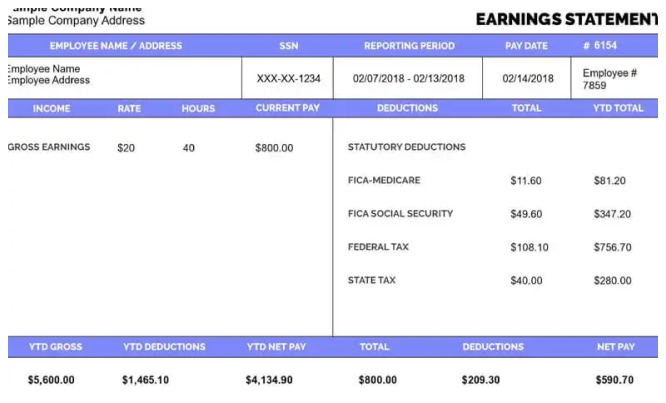

A free paycheck creator is an online tool that helps businesses generate accurate paychecks for their employees. It typically allows employers to input important details such as the employee’s hourly wage, salary, hours worked, tips, bonuses, tax deductions, and other relevant information. The tool then calculates the gross pay, deductions, and net pay, creating a detailed paycheck that can be shared with employees.

Free paycheck creators are often user-friendly, with templates and easy-to-follow instructions that ensure accurate calculations. Many of these tools also offer customization options for different types of employees, such as hourly workers, salaried employees, or those who receive tips.

How Free Paycheck Creators Help Prevent Payroll Mistakes

Here are several reasons why accountants recommend using free paycheck creators to avoid payroll errors:

1. Accurate Calculations

The most significant advantage of using a free paycheck creator is the accuracy it offers. These tools automatically calculate all aspects of an employee’s paycheck, including regular wages, overtime pay, tax deductions, and any additional earnings such as bonuses or commissions. By relying on an automated system, businesses can minimize the risk of human error, which is common when doing payroll manually.

For example, overtime pay is often a source of confusion for businesses. According to the Fair Labor Standards Act (FLSA), eligible employees must be paid at least time and a half for hours worked beyond 40 in a workweek. A paycheck creator can calculate overtime pay automatically based on an employee’s standard rate, reducing the risk of underpaying or overpaying.

2. Time Savings

Payroll processing can be time-consuming, especially for businesses with multiple employees. Manually calculating wages, tax deductions, and benefits for each employee can take hours, if not days. A free paycheck creator automates most of these tasks, significantly reducing the time required to generate paychecks. For small businesses with limited payroll staff, this time-saving feature is invaluable.

Additionally, free paycheck creators allow employers to generate paychecks in bulk for multiple employees at once, which is a great feature for businesses with a larger workforce.

3. Compliance with Tax Laws

One of the most challenging aspects of payroll is ensuring that all necessary tax deductions are applied correctly. Misclassifying an employee or failing to withhold the correct amount of federal, state, or local taxes can lead to legal problems. Free paycheck creators take the guesswork out of tax calculations by automatically applying the correct tax rates for different types of employees.

These tools also account for other deductions, such as Social Security and Medicare, and offer employees the option to track and manage their deductions for retirement plans, health insurance, and other benefits.

4. Reduced Risk of Human Error

Even the most detail-oriented payroll staff can make mistakes when manually calculating pay. A missed decimal point, an incorrect deduction, or a simple typo can lead to significant payroll issues. Free paycheck creators significantly reduce the risk of human error by automating these calculations, ensuring that every paycheck is accurate and compliant with regulations.

For example, if a business employs workers who receive tips, the paycheck creator can factor in tip income and ensure that it is treated correctly for tax purposes. This eliminates the need for manual tracking of tips and reduces the chance of payroll mistakes.

5. Clear Pay Stub Generation

A free paycheck creator doesn’t just generate a paycheck; it also creates a detailed pay stub that breaks down the employee’s earnings and deductions. This transparency is crucial for building trust with employees. Pay stubs show the exact breakdown of their wages, including their hourly rate, overtime pay, bonuses, tax deductions, and net pay.

Providing employees with a detailed pay stub helps to prevent misunderstandings regarding their pay, and it serves as documentation for personal and tax purposes. The clarity of the pay stub also makes it easier for employees to track their earnings and deductions, which is especially important when filing taxes or applying for loans.

6. Customizable Features

Every business has unique payroll needs. For example, a restaurant may need to account for tips, while a construction company may need to track overtime hours and hazard pay. Free paycheck creators allow businesses to customize the paystub to match their specific requirements. Customization options can include adding additional fields for commissions, bonuses, or company-specific benefits, ensuring that each paycheck reflects the employee’s actual earnings accurately.

7. Cost-Effective Solution

Many businesses, especially small ones, may not have the resources to hire an accountant or use expensive payroll software. Free paycheck creators offer a cost-effective alternative that helps businesses manage payroll without the need for costly software or outsourcing. While some more advanced payroll systems may come with additional features or require a subscription, many free paycheck creators provide all the tools needed to calculate wages and deductions at no cost.

How to Use a Free Paycheck Creator

Using a free paycheck creator is simple and straightforward. Here’s how businesses can get started:

- Choose a Reliable Tool: Start by selecting a free paycheck creator that suits your business needs. Look for tools that offer customizable templates and allow you to input all relevant payroll information, such as tax rates, overtime calculations, and employee details.

- Enter Employee Information: Input the necessary information for each employee, including their hourly wage or salary, hours worked, tax withholdings, and any additional earnings such as tips or bonuses.

- Review Calculations: Double-check the calculations to ensure accuracy. Most free paycheck creators will show a preview of the paystub before it’s finalized, allowing you to confirm that everything is correct.

- Generate the Paycheck: Once you’ve confirmed that the calculations are accurate, generate the paycheck or pay stub. Most tools will allow you to download the paystub as a PDF, which can be emailed to employees or printed for distribution.

- Store Pay Information: Some paycheck creators offer storage options, allowing you to save past paychecks for reference or audit purposes. This can be helpful for businesses that need to track payroll over time.

Conclusion

Payroll mistakes are costly, both in terms of time and money, but they are easily avoidable with the right tools. Free paystub creators provide businesses with an efficient, accurate, and cost-effective solution for managing payroll. By automating payroll calculations and ensuring compliance with tax laws, these tools help employers avoid common payroll mistakes that can lead to financial and legal complications.

Accountants recommend using free paycheck creators because they simplify payroll management, reduce the risk of errors, and improve overall business efficiency. Whether you run a small business or a large company, a free paycheck creator is an invaluable tool for ensuring that your employees are paid accurately, on time, and in compliance with the law.

If you’re ready to take the stress out of payroll, consider using a free paycheck creator for your business. With its accuracy, ease of use, and cost-effectiveness, it’s a decision that can save you time, money, and avoid unnecessary payroll errors.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons