Managing overtime pay is a critical part of any business’s payroll process. Whether you run a small business, a retail store, a tech company, or manage a team of workers across different industries, accurately calculating overtime is essential for staying compliant with labor laws and maintaining employee satisfaction. Fortunately, check stub makers are a powerful tool that can simplify overtime calculations and ensure your business stays on track.

In this blog, we’ll explore how check stub makers can streamline the process of calculating overtime, making your payroll process more accurate, efficient, and compliant with U.S. labor laws. We’ll cover everything you need to know, including overtime laws, how check stub makers work, and the benefits of using them for your payroll needs.

What is a Check Stub Maker?

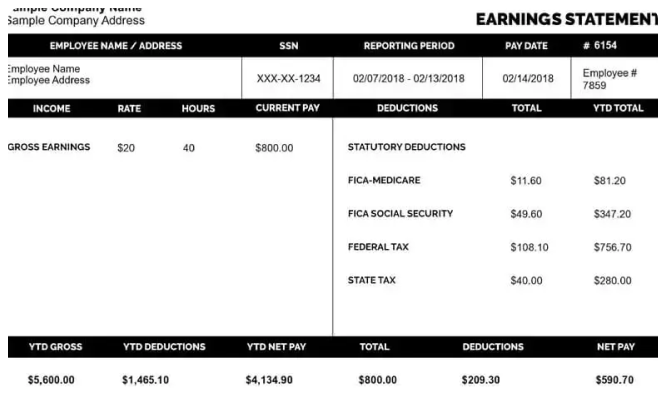

A check stub maker is an online tool or software that allows employers to generate accurate pay stubs for their employees. These pay stubs provide a detailed breakdown of an employee’s earnings, including regular wages, overtime pay, bonuses, and deductions for taxes and benefits. A check stub maker automates many payroll calculations, ensuring accuracy and saving employers time while simplifying payroll processes.

The tool can be used to create pay stubs for employees working different shifts, including those who are entitled to overtime pay based on the hours they work. By automating calculations, a check stub maker can help businesses ensure that employees are paid correctly and in compliance with overtime laws.

Understanding Overtime Pay

Before we dive into how check stub makers can help simplify overtime calculations, let’s take a moment to review what overtime pay is and how it works in the United States.

Overtime pay is the extra pay employees are entitled to when they work more than 40 hours in a workweek. According to the Fair Labor Standards Act (FLSA), non-exempt employees must be paid at least one and a half times their regular hourly rate for any hours worked beyond 40 hours per week. For example, if an employee’s regular hourly rate is $15 per hour, their overtime rate would be $22.50 per hour for any hours worked over 40 hours in a week.

Overtime Laws in the U.S.

There are a few key points to keep in mind when calculating overtime pay:

- Non-Exempt vs. Exempt Employees: Not all employees are entitled to overtime. The FLSA differentiates between exempt and non-exempt employees. Exempt employees, typically in managerial or professional roles, are not entitled to overtime pay, while non-exempt employees must receive overtime pay if they work more than 40 hours per week.

- Overtime Pay for Different Types of Workers: Overtime laws apply differently depending on the type of work employees do and the state they work in. Some states have laws that are stricter than federal regulations, requiring higher overtime rates or different rules for calculating overtime.

- Overtime for Multiple Job Types: If an employee works multiple jobs within the same company, overtime calculations can get complicated. The check stub maker can help track hours worked in different roles and ensure the correct overtime rate is applied based on their work.

How a Check Stub Maker Helps with Overtime Calculations

Overtime pay can be tricky, especially for businesses with multiple employees, different shifts, or workers in various states. Fortunately, a check stub maker can simplify overtime calculations in several ways.

1. Automatic Overtime Calculations

One of the primary benefits of using a check stub maker is that it automates overtime calculations. By entering an employee’s regular hourly rate and the total number of hours worked, the check stub maker will automatically calculate the overtime hours and apply the correct overtime rate.

For example, let’s say an employee works 50 hours in a week. The check stub maker will calculate 40 hours of regular pay and 10 hours of overtime pay at 1.5 times the employee’s hourly rate. This automation ensures accuracy, reduces the chances of human error, and saves time compared to manually calculating overtime.

2. Tracking Overtime Hours Across Pay Periods

Another helpful feature of a check stub maker is that it allows businesses to track overtime hours over multiple pay periods. This can be especially useful for employees who work overtime sporadically or across different weeks. A check stub maker can provide a clear, easy-to-read record of how many overtime hours an employee has worked during a specific period, making it easier for employers to stay compliant with labor laws.

Having accurate records of overtime hours worked is essential for audits, tax filings, and resolving any disputes that may arise between employers and employees.

3. State-Specific Overtime Rules

Each state in the U.S. may have slightly different rules regarding overtime pay, such as higher overtime rates or unique labor regulations. A check stub maker can help businesses stay compliant with these state-specific laws by allowing for customization based on the employee’s work location.

For example, if you have employees in California, where overtime laws are stricter than in many other states, a check stub maker can ensure that overtime is calculated at the correct rate, which includes double-time pay for hours worked beyond a certain threshold. With a check stub maker, employers can set up different pay rules for employees based on where they work, reducing the risk of non-compliance.

4. Adjusting for Shift Differentials and Special Overtime Rules

In certain industries, such as healthcare or manufacturing, employees may be entitled to additional pay for working during specific hours (e.g., night shifts or weekends). A check stub maker can help with shift differentials by automatically applying the correct pay rate when an employee works outside of regular hours.

For example, if an employee has a standard hourly rate of $15 per hour but is entitled to an additional $5 per hour for working a night shift, the check stub maker can automatically calculate the correct pay for the night shift hours worked. This ensures that employees are paid fairly for their work and that businesses comply with labor regulations.

5. Avoiding Payroll Mistakes and Penalties

Payroll mistakes, especially related to overtime pay, can be costly for businesses. Incorrect overtime calculations can lead to underpayment of employees, which may result in penalties, lawsuits, or legal claims. By using a check stub maker, employers can reduce the risk of these mistakes, ensuring that employees are paid accurately and in compliance with the law.

Moreover, check stub makers often include features that allow employers to review calculations before finalizing payroll, helping to catch errors before they become an issue. This review process provides an additional layer of oversight, which is particularly important when handling overtime calculations.

Benefits of Using a Check Stub Maker for Overtime Calculations

The use of a check stub maker offers several key advantages for businesses, including:

- Efficiency: Automating overtime calculations saves time and reduces the administrative burden on payroll teams, allowing them to focus on other important tasks.

- Accuracy: A check stub maker eliminates the risk of human error when calculating overtime, ensuring that employees are paid correctly for their additional hours worked.

- Compliance: By ensuring that overtime is calculated in accordance with federal and state labor laws, a check stub maker helps businesses remain compliant and avoid potential fines and lawsuits.

- Transparency: Employees appreciate receiving clear, accurate pay stubs that break down their regular and overtime pay, promoting trust and transparency in the workplace.

- Record Keeping: A check stub maker provides businesses with a detailed record of overtime hours worked and pay calculations, which can be useful for audits, tax filing, and resolving disputes.

Conclusion

Calculating overtime pay doesn’t have to be complicated. By using a check stub maker, businesses can automate the process, ensuring accurate overtime calculations, staying compliant with labor laws, and avoiding costly mistakes. Whether you’re managing a small team or overseeing a large workforce, a check stub maker can simplify the payroll process, reduce administrative workload, and promote transparency with your employees. As overtime calculations become more complex, investing in a reliable check stub maker can save time and help businesses avoid compliance issues, ultimately leading to a smoother and more efficient payroll system.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown