Creating accurate and professional pay stubs is essential for businesses of all sizes. A pay stub not only serves as proof of income for employees but also ensures compliance with labor laws, taxes, and company policies. For small businesses, startups, and entrepreneurs, paying for expensive payroll services or software can be costly. The good news is, you can create custom pay stubs for your employees with a pay stub creator free tool, making the process efficient and cost-effective.

In this blog, we’ll walk you through how to create custom pay stubs for your employees using a free pay stub creator tool. Whether you’re a small business owner or a freelancer, this guide will help you understand the benefits, features, and steps to get started.

What is a Pay Stub and Why is it Important?

Before diving into how to create a pay stub, let’s briefly discuss what a pay stub is and why it’s crucial for both employers and employees.

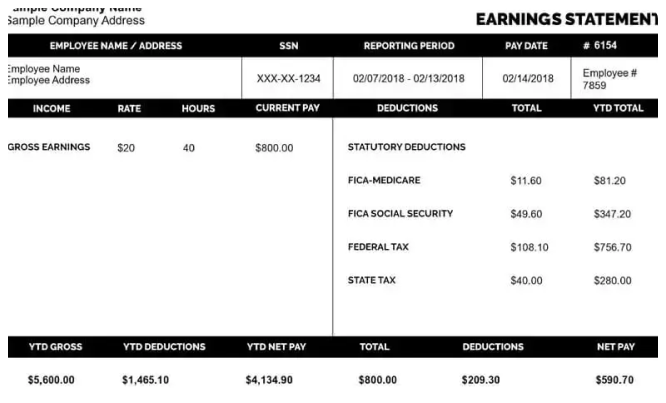

A pay stub is a document provided to employees along with their paycheck that outlines their earnings and any deductions taken from their pay. It typically includes the following details:

- Employee Information: Name, address, and sometimes the job title or department.

- Earnings: Total gross pay, including regular hours, overtime, and bonuses.

- Deductions: Taxes (federal, state, and local), Social Security, Medicare, retirement contributions, insurance, and other voluntary deductions.

- Net Pay: The amount an employee takes home after all deductions have been made.

Providing employees with detailed pay stubs is not only a legal requirement in many states but also helps to maintain transparency in your payroll system. Employees can use their pay stubs for various purposes, such as applying for loans, renting an apartment, or filing taxes.

Why Use a Free Pay Stub Creator Tool?

As a small business or self-employed individual, manually creating pay stubs can be time-consuming, especially when dealing with multiple employees or varying pay rates. Instead of spending hours on complicated spreadsheets or hiring expensive payroll services, a pay stub creator free tool offers an efficient and simple solution.

Here are a few reasons why using a free pay stub creator is a smart choice:

- Cost-Effective: Free tools allow you to generate professional pay stubs without the added cost of subscription fees or software.

- Time-Saving: Automation takes the guesswork out of calculations and ensures that pay stubs are generated quickly.

- Accurate Calculations: Most free pay stub creators automatically calculate taxes, deductions, and overtime, ensuring accuracy every time.

- Customization: You can customize the format, design, and details to meet your business’s specific payroll needs.

- Legal Compliance: Using a tool that generates pay stubs ensures you meet legal requirements for payroll transparency and tax reporting.

Features to Look for in a Free Pay Stub Creator Tool

When choosing a pay stub creator free tool, it’s important to consider its features to ensure it meets your needs. Here are some key features to look for:

- Easy-to-Use Interface: The tool should have a user-friendly interface that’s easy to navigate, even for those with little experience in payroll processing.

- Customizable Templates: Look for a tool that offers customizable templates, allowing you to adjust the layout, design, and content to match your branding and business requirements.

- Tax Calculations: The tool should automatically calculate federal, state, and local taxes, as well as Social Security and Medicare contributions. Some tools may also calculate deductions for retirement plans, insurance, and other benefits.

- Support for Multiple Pay Periods: Ensure the tool can handle different pay periods (weekly, bi-weekly, monthly, etc.), depending on your payroll schedule.

- Overtime and Bonus Calculations: For businesses that require overtime or bonuses, the tool should automatically calculate these amounts based on your input.

- Download and Print Options: A good pay stub creator should allow you to download and print pay stubs in PDF format for easy distribution to employees.

- Employee Record Keeping: Some free tools allow you to store employee pay records, making it easier to manage payroll history and generate reports.

- Security: Look for a tool that offers data security and privacy features to ensure your employees’ sensitive payroll information is protected.

Step-by-Step Guide: How to Create Custom Pay Stubs with a Free Tool

Now that you know the benefits and features of a pay stub creator free tool, let’s walk through the process of creating custom pay stubs for your employees.

1. Choose a Free Pay Stub Creator Tool

First, select a free pay stub creator tool that suits your business needs. You can find several online tools with both free and paid options. Some popular options include PayStubCreator, Check Stub Maker, and PayStubDirect. Most of these platforms offer a free version with basic features and the option to upgrade for additional features.

2. Input Employee Information

Once you’ve chosen your pay stub creator, you’ll typically start by entering basic employee information, such as:

- Employee’s Name and Address: This is important for record-keeping and tax purposes.

- Employer’s Information: Include your business name, address, and contact details.

- Pay Period: Specify the start and end dates for the pay period (weekly, bi-weekly, monthly, etc.).

Make sure that all the information is accurate and up-to-date to avoid errors in the pay stub.

3. Enter Earnings Information

Next, input the employee’s earnings for the pay period. This will include:

- Regular Hours: The number of regular hours worked during the pay period at the standard rate.

- Overtime Hours: If applicable, enter the number of overtime hours worked and the overtime rate (typically 1.5 times the regular hourly rate).

- Bonuses or Commission: If your employee earned any bonuses, commissions, or tips, you can enter these as additional earnings.

The tool will automatically calculate the total gross earnings based on the hours worked and any bonuses or commissions.

4. Add Deductions

Most pay stub creator tools will prompt you to enter deductions, which are subtracted from an employee’s gross pay. Common deductions include:

- Federal and State Taxes: The tool should calculate these automatically based on the employee’s tax status (e.g., single, married) and any allowances they claim on their W-4 form.

- Social Security and Medicare: These deductions are typically set rates (6.2% for Social Security and 1.45% for Medicare).

- Retirement Contributions: If your employee is contributing to a 401(k) or other retirement plan, input the percentage or dollar amount.

- Health Insurance: If applicable, enter any health insurance premiums or deductions.

The pay stub creator will subtract these deductions from the employee’s gross pay to calculate the net pay.

5. Review and Customize the Pay Stub

Before finalizing the pay stub, review all the information to ensure accuracy. Double-check that the earnings, deductions, and any other details are correct. Some free pay stub creators allow you to customize the design and layout of the pay stub, so you can add your company logo, change the font, or adjust the color scheme to match your branding.

6. Generate and Download the Pay Stub

Once you’ve reviewed everything, click the button to generate the pay stub. The tool will automatically create a professional pay stub that includes all the necessary information.

You can then download the pay stub in PDF format, which can be easily emailed to the employee or printed for physical distribution. Many tools also offer the option to store pay stubs in an online employee portal for easy access.

7. Distribute the Pay Stubs to Employees

Finally, distribute the pay stubs to your employees. You can either print them and hand them out physically or email them directly to your employees. If your business operates remotely or you have employees working in different locations, the digital format is often more efficient.

Benefits of Using Custom Pay Stubs for Your Employees

Creating custom pay stubs for your employees offers numerous benefits beyond just paying them accurately. Some key advantages include:

- Transparency: Custom pay stubs show employees exactly how their pay is calculated, including deductions for taxes, insurance, and retirement. This transparency builds trust between employers and employees.

- Record Keeping: Pay stubs serve as an official record of earnings and deductions for both employers and employees. Employees can use them for tax purposes or when applying for loans.

- Legal Compliance: Many states require employers to provide pay stubs. By using a pay stub creator, you ensure you’re meeting legal requirements for wage transparency and tax reporting.

- Professionalism: Custom pay stubs with your company’s branding look more professional than handwritten ones, enhancing your business’s reputation.

Conclusion

Using a pay stub creator free tool to generate custom pay stubs for your employees is a simple, cost-effective way to ensure accurate and professional payroll management. By automating the process, you can save time, reduce errors, and stay compliant with tax and labor laws. Whether you run a small business, a startup, or are self-employed, a free pay stub creator offers an efficient solution to manage payroll without the need for expensive software or services.

With the right tool and a few simple steps, you can create custom pay stubs that are clear, professional, and legally compliant—helping your business stay organized while keeping your employees happy and informed.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons