Keeping track of income and expenses is crucial for both employees and employers. A paystub creator simplifies this process by generating accurate, professional paystubs. Whether you’re a freelancer, small business owner, or an employee needing proof of income, using a paystub creator ensures financial clarity.

This blog explores the benefits of using a paystub creator and how it helps maintain accurate financial records.

Why Accurate Financial Records Matter

Accurate financial records are essential for multiple reasons, including:

-

Tax Filing – A clear earnings record helps with tax calculations and deductions.

-

Loan Applications – Banks require proof of income for mortgages, car loans, and credit card approvals.

-

Budgeting & Expense Tracking – Knowing your exact earnings allows better financial planning.

-

Employment Verification – Many jobs or rental applications require proof of consistent income.

A paystub creator simplifies these processes, clearly separating earnings, deductions, and net pay.

Who Can Benefit from a Paystub Creator?

1. Small Business Owners

Managing payroll for employees can be challenging. A paystub creator allows business owners to generate professional paystubs quickly, ensuring compliance with financial regulations.

Benefits:

-

Saves time and effort in manual calculations

-

Reduces errors in payroll processing

-

Helps maintain organized financial records

2. Freelancers & Self-Employed Individuals

Freelancers often struggle with proving income due to irregular payments. A paystub creator helps generate structured paystubs, making financial management easier.

Benefits:

-

Acts as proof of income for tax filing and loan applications

-

Helps track earnings from multiple clients

-

Provides a professional record for financial transactions

3. Employees

Employees can use a paystub creator to verify their earnings and track deductions, ensuring they receive fair pay.

Benefits:

-

Cross-check salary payments with employer records

-

Helps in tax filing and refund calculations

-

Provides documentation for rental or loan applications

4. Contractors & Gig Workers

Independent contractors and gig workers, such as Uber drivers or delivery personnel, often get paid without traditional paystubs. A paystub creator helps them maintain accurate earnings records.

Benefits:

-

Simplifies tax preparation with structured income details

-

Helps apply for loans or mortgages

-

Creates transparency in financial management

Don’t Miss: Free Paystub Generator

Key Features of a Paystub Creator

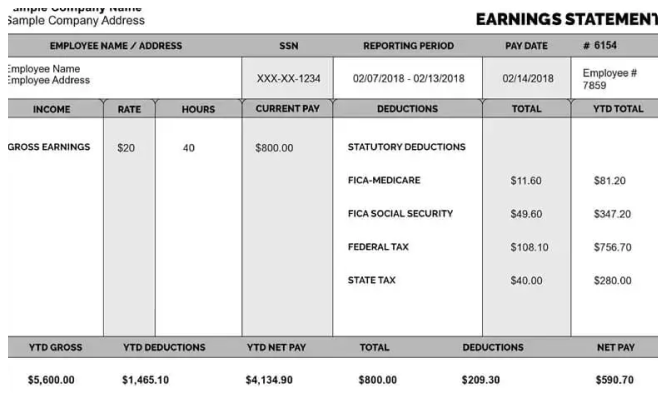

A paystub creator offers various features that make financial record-keeping easier:

1. Automatic Calculations

Manually calculating wages, deductions, and taxes manually is time-consuming. A paystub creator automates these calculations, reducing errors and ensuring accuracy.

2. Customization Options

Users can customize paystubs by adding business names, logos, payment details, and tax deductions, making them professional and personalized.

3. Instant Download & Printing

With a paystub creator, users can generate paystubs instantly, download them in PDF format, and print them for documentation.

4. Compliance with Tax Regulations

Many paystub creators are designed to align with tax regulations, ensuring the correct deductions for Social Security, Medicare, and federal/state taxes.

5. Record Keeping & Organization

Digital paystubs make it easy to track earnings, expenses, and tax payments, eliminating the hassle of paper records.

How to Use a Paystub Creator

Using a paystub creator is simple and requires only a few steps:

-

Enter Personal or Business Details – Input your name, employer name, and contact information.

-

Add Payment Information – Include gross wages, hours worked, and payment frequency.

-

Include Deductions & Taxes – The tool will calculate tax deductions, health benefits, and other withholdings.

-

Preview & Generate Paystub – Review the details for accuracy.

-

Download & Save – Save a digital copy or print it for reference.

Common Questions About Paystub Creators

Is a Paystub Creator Legal?

Yes! A paystub creator is a legal and widely accepted tool for documenting earnings, provided the information entered is accurate and truthful.

Can I Use a Paystub Creator for Tax Filing?

Yes, paystubs generated from a paystub creator help track earnings and deductions, making tax filing easier.

Is It Safe to Use a Paystub Creator?

Reputable paystub creators use secure encryption to protect personal and financial information.

Conclusion

A paystub creator is a valuable tool for employees, freelancers, contractors, and business owners. It simplifies payroll processing, ensures financial accuracy, and helps with tax filing, budgeting, and loan applications. By using a free paystub creator, individuals and businesses can maintain organized financial records, reducing stress and improving financial stability.

If you need an easy, reliable way to create paystubs, consider using a paystub creator today!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown