Managing payroll can be one of the most time-consuming and stressful tasks for any business, regardless of its size. Accurate calculations, timely payments, and proper record-keeping are all essential components of an effective payroll system. However, for many small business owners, freelancers, or anyone managing employees, handling these tasks manually can lead to mistakes, delays, and frustration.

Luckily, there is a simple and efficient solution: a free payroll check maker. With this tool, businesses can generate paychecks easily, ensuring that employees are paid on time and accurately. In this blog, we will explore how a free paycheck creator can make payroll management simpler, reduce errors, and ultimately improve the overall payroll process for both employers and employees.

1. The Challenge of Managing Payroll

Payroll management involves a lot of moving parts. You need to ensure that employees are paid on time, that the correct taxes are deducted, and that benefits and overtime are properly calculated. Unfortunately, many small business owners or freelance employers face challenges when it comes to managing payroll, such as:

- Time-consuming manual calculations: Payroll requires calculating wages, tax withholdings, and deductions, which can take hours each pay period if done by hand.

- Risk of errors: With manual payroll management, there is always the risk of making mistakes in calculations, which can lead to underpayment or overpayment.

- Tracking employee hours: For hourly workers, accurately tracking the hours worked is essential. Mismanagement of this can lead to disputes and dissatisfaction.

- Compliance issues: Ensuring that all tax laws are followed and that the correct amount of tax is withheld is a huge responsibility. Failure to do so can result in penalties or fines.

To address these problems, businesses need an efficient and automated payroll solution, and that’s where a free paycheck creator comes in.

2. What is a Free Payroll Check Maker?

A free payroll check maker is a tool that allows employers to create accurate and professional paychecks for their employees. These tools simplify payroll by automating the calculations of wages, deductions, taxes, and benefits, making it easier for businesses to manage employee payments.

Many free paycheck creators are online tools that can generate paychecks based on the information you input. The platform allows you to enter details such as employee hours worked, hourly rates, salaries, tax information, and deductions. The system then calculates the gross pay, applies the relevant deductions, and provides you with a final paycheck for each employee.

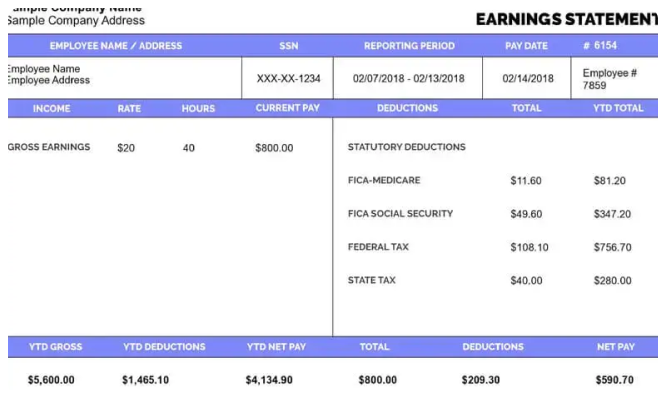

Some free paycheck creators also offer pay stub generation, which allows employers to provide detailed records of each paycheck, showing employees exactly how their pay was calculated.

3. How a Free Payroll Check Maker Makes Payroll Easier

Here are some of the key ways a free paycheck creator simplifies payroll management:

a. Streamlines Payroll Processing

The process of creating paychecks can be complicated when done manually. It often involves calculating pay based on hours worked, applying tax rates, accounting for overtime, and adjusting for any other deductions. A free paycheck creator simplifies this by automating these calculations, meaning you don’t have to do them by hand every pay period. This helps you save valuable time and ensures that payroll is processed much faster.

b. Reduces Errors in Calculations

Manual payroll management is prone to errors. A simple mistake in tax calculation, missing an overtime rate, or entering the wrong hourly rate can result in serious payroll discrepancies. Using a free payroll check maker ensures that all calculations are done automatically and accurately. This minimizes the risk of errors and ensures employees are paid correctly every time.

c. Ensures Compliance with Tax Laws

Tax regulations are constantly changing, and businesses must stay up to date to ensure compliance. A free paycheck creator is designed to calculate and withhold the correct amount of taxes based on the current laws. This takes the guesswork out of payroll and ensures that your business remains compliant with federal, state, and local tax laws.

d. Easily Tracks Hours Worked

For businesses that employ hourly workers, tracking hours worked can be a challenge. Mistakes in logging hours can lead to overpayment or underpayment, which can damage employee trust. Many free paycheck creators come with time-tracking features, allowing you to input employee hours directly into the system. This ensures that employees are paid accurately based on the hours they worked.

e. Provides Pay Stubs for Employees

Providing employees with pay stubs is essential for record-keeping and transparency. With a free paycheck creator, you can easily generate professional pay stubs for each employee, which clearly show their gross pay, deductions, and net pay. This helps employees understand how their pay is calculated and allows them to easily track their earnings and deductions for tax purposes.

4. Key Features of a Free Paycheck Creator

When selecting a free payroll check maker, there are several important features to look for. These features ensure that the tool is comprehensive, user-friendly, and capable of meeting all your payroll needs.

a. Tax Calculation and Deduction Tools

One of the main advantages of using a free paycheck creator is its ability to automatically calculate taxes and deductions. Most paycheck creators are equipped with up-to-date tax tables that ensure correct federal, state, and local tax deductions are made. Additionally, the system can calculate deductions for benefits such as health insurance or retirement contributions.

b. Support for Different Pay Structures

Whether you have salaried employees, hourly workers, or contractors, a free paycheck creator should be able to handle different pay structures. Many tools can accommodate various pay types, such as weekly, bi-weekly, or monthly pay periods, and ensure that employees are paid correctly regardless of their role.

c. User-Friendly Interface

A free payroll check maker should be easy to use, even for business owners with little to no payroll experience. The tool should have a simple interface that walks you through each step of the process, allowing you to input employee details, calculate pay, and generate paychecks quickly. Look for a tool with clear instructions and a clean design to avoid confusion.

d. Multiple Payment Methods

Some free paycheck creators offer multiple ways to deliver paychecks to employees. While paper checks are an option, many platforms also support direct deposit, which allows employees to receive their pay electronically. This saves time and ensures employees receive their pay faster.

e. Customizable Pay Stubs

Customizable pay stubs allow employers to include relevant information specific to their business. A free paycheck creator should allow you to customize the look of the pay stub, add company logos, and adjust the formatting to match your business’s needs. This ensures that pay stubs look professional and consistent.

5. Benefits for Small Businesses

For small businesses, managing payroll can often seem like a daunting task. Payroll systems can be expensive, and small business owners may not have the time or resources to manage everything manually. A free paycheck creator can make a huge difference for small businesses in several ways:

a. Saves Time and Effort

By automating calculations and paystub generation, a free payroll check maker saves small business owners a great deal of time. Instead of spending hours on payroll, you can process it in just a few minutes. This time-saving aspect allows you to focus on growing your business and serving your customers.

b. Low-Cost Solution

Many small businesses operate on tight budgets, and investing in an expensive payroll service may not be feasible. A free paycheck creator offers an affordable solution to payroll management, helping businesses manage their payroll without breaking the bank.

c. Professionalism and Transparency

Small businesses can struggle with maintaining professionalism in payroll management, especially when working with freelancers or contractors. Using a free payroll check maker allows you to issue professional paychecks and pay stubs, ensuring that your employees, contractors, or freelancers feel valued and respected.

6. How a Free Payroll Check Maker Improves Employee Trust

When employees receive accurate, timely paychecks and clear pay stubs, their trust in the employer grows. A free paycheck creator helps build this trust by ensuring that employees are paid correctly every time and that all deductions are properly applied. Transparent payroll practices create a positive work environment and help foster employee loyalty.

By eliminating errors in payroll and reducing the time spent on calculations, a free payroll check maker allows employers to show that they value their employees’ time and effort. This increases overall satisfaction and reduces turnover rates.

7. Conclusion

Managing payroll doesn’t have to be a stressful and time-consuming process. With the help of a free payroll check maker, business owners can simplify the payroll process, ensure accuracy, and provide employees with the pay they deserve. From accurate tax calculations to customizable pay stubs, a free paycheck creator offers numerous benefits for businesses of all sizes.

Whether you’re a small business owner, a freelancer managing your team, or a company looking to streamline payroll, using a free payroll check maker is an easy and effective way to keep your payroll running smoothly and maintain employee satisfaction. By reducing errors, saving time, and ensuring compliance, this tool can make a significant difference in how you manage your workforce and keep your employees happy.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?

Access Your Pay Information Using eStub in 2025