In the fast-paced world of healthcare, managing payroll efficiently is a critical task for medical practices of all sizes. With multiple employees working in various roles, from doctors and nurses to administrative staff and support teams, it’s essential to maintain accurate records of employee earnings, taxes, and deductions. One of the simplest yet most effective tools that can assist medical practices in managing payroll efficiently is a paystub template.

A paystub is a document provided to employees with each paycheck, detailing the breakdown of their earnings, deductions, and other important financial information. By using a paystub template, medical practices can ensure that their payroll system remains organized, transparent, and compliant with local, state, and federal regulations. In this blog, we’ll explore why paystub templates are important for medical practices, their benefits, and how they can be used to streamline payroll management.

What Is a Paystub Template?

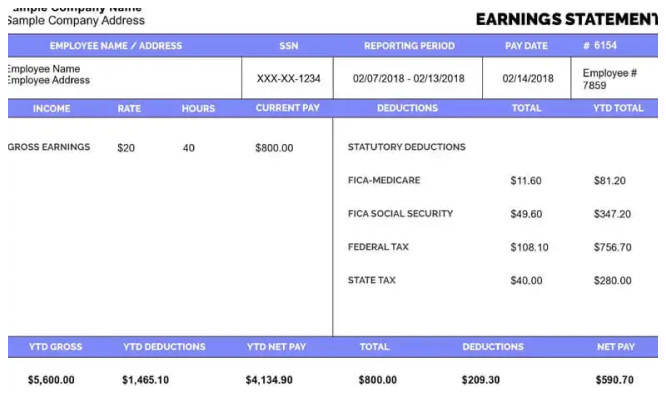

A paystub template is a pre-designed document that allows medical practices to easily input relevant payroll information, including an employee’s gross income, taxes withheld, deductions, benefits, and net pay. The template is formatted to meet legal and regulatory requirements, and it can be used by payroll administrators to generate accurate paystubs quickly and consistently.

Paystub templates are available in various formats, such as PDF, Excel, or Word, and can be customized to suit the specific needs of the medical practice. By utilizing a template, medical practices can avoid the hassle of creating paystubs from scratch for every paycheck, ensuring efficiency and accuracy.

Why Medical Practices Need Paystub Templates

1. Streamlined Payroll Processing

Managing payroll in a medical practice can be a complicated and time-consuming task. With various staff members working different shifts and roles, keeping track of their earnings, deductions, and taxes can be overwhelming. A paystub template simplifies the process by offering a structured format to input and calculate all the necessary information.

The template automatically breaks down the earnings and deductions, making the payroll process quicker and reducing the chances of mistakes. This allows the payroll administrator to focus on other important tasks while ensuring employees receive their pay on time and accurately.

2. Accuracy and Consistency

When handling payroll, accuracy is crucial. Any mistakes can lead to errors in employee compensation, resulting in dissatisfaction and potential legal consequences. Using a paystub template ensures that each paystub includes the correct details, such as hours worked, overtime pay, taxes, and benefits.

Since the template provides a consistent layout, the payroll information is always structured in the same way, reducing the risk of missing or incorrectly entered data. This consistency helps payroll administrators avoid common errors, and employees can easily understand their paystub without confusion.

3. Compliance with Legal Requirements

Medical practices are required to comply with federal, state, and local tax laws when processing payroll. These regulations dictate how wages should be calculated, what deductions need to be made, and what information must be included on the paystub.

A paystub template helps ensure that all necessary information is included on the paystub, such as:

- Employee’s gross wages

- Tax deductions (federal, state, and local)

- Social Security and Medicare contributions

- Retirement plan contributions

- Health insurance deductions

- Overtime pay

- Paid time off (PTO)

By using a template that adheres to legal standards, medical practices can avoid legal troubles and ensure they are meeting payroll obligations.

4. Transparency for Employees

One of the key advantages of using a paystub template is the level of transparency it provides to employees. When employees receive their paystubs, they can clearly see how their paycheck was calculated, including any deductions, benefits, and taxes.

For medical practices, this transparency is important for maintaining employee trust. For example, healthcare workers often have various benefit options, such as health insurance or retirement contributions, that are deducted from their pay. A paystub template clearly shows these deductions, allowing employees to track their contributions and ensure they are accurate.

5. Improved Record-Keeping

Keeping accurate records of payroll is essential for both operational efficiency and compliance purposes. Medical practices are required to retain payroll records for several years for tax and auditing purposes. A paystub template makes this process much easier by providing a consistent format for every paycheck issued.

By using a template, the payroll department can quickly reference past paystubs if needed, and all records will be neatly organized and easy to access. This can be particularly helpful in the event of an audit or when responding to employee inquiries about their pay history.

6. Easy Integration with Payroll Software

Many modern payroll systems are designed to integrate with paystub templates, making it easy for medical practices to generate paystubs automatically. These templates can be pre-configured to work with accounting software, enabling payroll administrators to quickly enter the necessary data and generate paystubs with minimal effort.

This integration streamlines the payroll process even further and minimizes the risk of errors. The system can automatically calculate taxes, benefits, and deductions based on the information provided, reducing the need for manual calculations.

How to Use a Paystub Template in Your Medical Practice

Using a paystub template in a medical practice is a straightforward process. Here are the basic steps to get started:

1. Choose the Right Template

The first step is to choose a template that fits your practice’s needs. There are many free and paid templates available online, ranging from simple designs to more complex options with advanced features. Make sure the template is compatible with your payroll software and meets your legal requirements.

2. Input Employee Information

Once you have selected a template, you will need to input relevant information for each employee, including their:

- Name and address

- Job title

- Hours worked

- Pay rate

- Overtime hours (if applicable)

- Benefits and deductions

Ensure that all information is accurate to avoid discrepancies in employee pay.

3. Calculate Pay and Deductions

The next step is to calculate the employee’s gross pay, taxes, and any other deductions. If your template includes built-in formulas, this will be automated for you. Otherwise, you can manually calculate these amounts and input them into the template.

4. Generate the Paystub

After entering the necessary information, you can generate the paystub. Most templates allow you to save the document as a PDF, which can then be printed or emailed to employees. Some payroll systems also allow for direct deposit payments, which can be accompanied by an electronic copy of the paystub.

5. Distribute the Paystub

Once the paystubs are generated, you can distribute them to employees. Many medical practices now offer electronic paystubs, which employees can access through an online portal. Alternatively, you can print physical copies and distribute them during payroll runs.

Conclusion

A paystub template is an invaluable tool for medical practices looking to streamline their payroll process. It ensures that all necessary information is included, improves accuracy and consistency, and helps medical practices stay compliant with tax regulations. Additionally, paystub templates provide transparency for employees and simplify record-keeping, making them an essential tool for any healthcare business.

By adopting a paystub template as part of your payroll process, you can save time, reduce errors, and create a more efficient payroll system that benefits both your practice and your employees.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?