A pay stub template is an essential tool for businesses and employees. It provides a detailed breakdown of earnings, deductions, and net pay. Whether you are an employer creating pay stubs for your workers or an employee reviewing your paycheck, understanding the key components of a pay stub is crucial.

Using a well-structured pay stub template ensures accuracy, transparency, and compliance with labor laws. In this article, we’ll explain what should be included in a pay stub template, why each section matters, and how to create an effective one.

Why Is a Pay Stub Important?

A pay stub, also called a check stub, is a document that outlines an employee’s earnings and deductions for a specific pay period. It helps with:

✅ Payroll Accuracy – Ensures employees are paid correctly.

✅ Tax Compliance – Helps in filing taxes and reporting income.

✅ Proof of Income – Needed for loans, rentals, and financial applications.

✅ Employee Transparency – Builds trust by showing how pay is calculated.

A well-designed pay stub template includes all necessary details to make payroll clear and easy to understand.

Key Components of a Pay Stub Template

A complete pay stub should include the following sections:

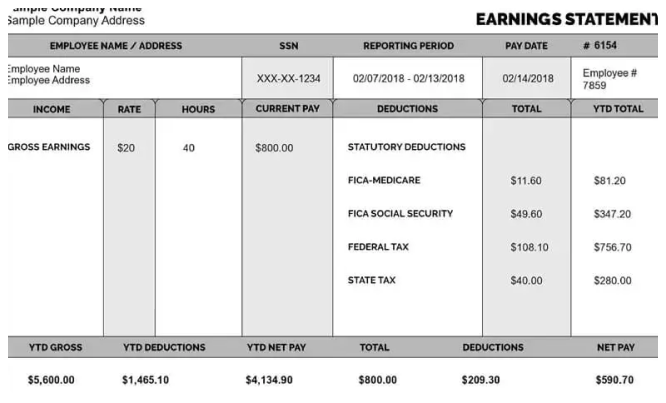

1️⃣ Employee Information

This section identifies the employee and should include:

✔ Full Name (First and last name)

✔ Employee ID Number (If applicable)

✔ Address (Optional, but useful for records)

✔ Social Security Number (SSN) (Last four digits for security)

💡 Why It’s Important: Helps ensure the pay stub is assigned to the correct person.

2️⃣ Employer Information

The pay stub should also include business details, such as:

✔ Company Name

✔ Company Address

✔ Employer Identification Number (EIN) (If applicable)

✔ Contact Information

💡 Why It’s Important: Provides official employer details for tax and legal purposes.

3️⃣ Pay Period and Pay Date

Every pay stub must specify:

✔ Pay Period Start and End Dates – Example: March 1 – March 15, 2025

✔ Pay Date – The date the employee is paid

💡 Why It’s Important: Helps employees track when they were paid for a specific period.

4️⃣ Gross Earnings (Total Pay Before Deductions)

This section shows the total amount earned before any deductions. It varies based on:

For Hourly Employees:

✔ Hourly Wage × Hours Worked

✔ Overtime Pay (if applicable)

📝 Example: If an employee works 40 hours at $20 per hour, their gross pay is:

40 × $20 = $800

For Salaried Employees:

✔ Annual Salary ÷ Number of Pay Periods

📝 Example: If an employee earns $52,000 per year and is paid biweekly, their gross pay is:

$52,000 ÷ 26 = $2,000 per paycheck

💡 Why It’s Important: Shows employees their total earnings before deductions.

5️⃣ Deductions (Taxes and Benefits)

Deductions reduce the gross pay to calculate the net pay. These include:

Mandatory Deductions:

✔ Federal Income Tax – Based on the employee’s tax bracket

✔ State Income Tax – Varies by state (some states don’t have this tax)

✔ Social Security Tax (FICA) – 6.2% of gross pay

✔ Medicare Tax (FICA) – 1.45% of gross pay

Voluntary Deductions (if applicable):

✔ Health Insurance Premiums

✔ Retirement Contributions (401k, IRA)

✔ Union Dues

✔ Garnishments (e.g., child support, debt payments)

📝 Example: If an employee has $2,000 in gross pay and their deductions total $400, their net pay is:

$2,000 – $400 = $1,600

💡 Why It’s Important: Ensures employees understand how much is deducted and why.

6️⃣ Net Pay (Take-Home Pay)

Net pay is the final amount the employee receives after deductions. It’s calculated as:

Gross Pay – Deductions = Net Pay

💡 Why It’s Important: This is the actual amount deposited into an employee’s bank account or given via check.

7️⃣ Overtime, Bonuses, and Additional Earnings

If an employee earns extra income, the pay stub should list:

✔ Overtime Pay – 1.5× the hourly wage for overtime hours

✔ Bonuses/Commissions – Any additional earnings

✔ Holiday Pay – If the employee worked on holidays

✔ Paid Time Off (PTO) – Sick leave, vacation, or personal days

💡 Why It’s Important: Helps employees track additional earnings beyond their base salary.

8️⃣ Payment Method (How the Employee Was Paid)

A pay stub should indicate how the payment was made:

✔ Direct Deposit – Funds sent to a bank account

✔ Paper Check – A physical paycheck given to the employee

✔ Cash Payment – If applicable

💡 Why It’s Important: Ensures employees know how and when they received their paycheck.

9️⃣ Year-to-Date (YTD) Totals

YTD totals show cumulative earnings and deductions for the year. A pay stub should include:

✔ YTD Gross Pay – Total earnings before deductions

✔ YTD Deductions – Total taxes and other deductions

✔ YTD Net Pay – Total take-home pay for the year

💡 Why It’s Important: Helps employees track total income for tax reporting.

How to Create a Professional Pay Stub Template

There are several ways to create a pay stub template:

✔ Use Payroll Software – QuickBooks, ADP, and Gusto generate accurate pay stubs.

✔ Excel or Google Sheets Templates – Customizable for small businesses.

✔ Online Pay Stub Generators – Websites like PayStubCreator make it easy to generate professional check stubs.

💡 Tip: Choose a pay stub template that is clear, professional, and easy to understand.

Final Thoughts: What Should Be Included in a Pay Stub Template?

A pay stub template should be detailed yet easy to read. By including employee details, earnings, deductions, and net pay, businesses can ensure payroll transparency and accuracy.

✅ Key Takeaways:

✔ A pay stub should include employee and employer information

✔ Gross pay, deductions, and net pay must be clearly listed

✔ Include overtime, bonuses, and additional earnings

✔ Use YTD totals for tracking annual income

✔ Choose a professional pay stub template for accuracy