In today’s fast-paced world, managing finances is a crucial skill. Whether you are an employee looking to keep track of your earnings or an employer aiming to streamline payroll processes, a paycheck stub generator can be a game changer. In this blog, we will explore how these tools benefit both employees and employers, highlighting the importance of check stubs and their role in financial management.

Understanding Paycheck Stubs

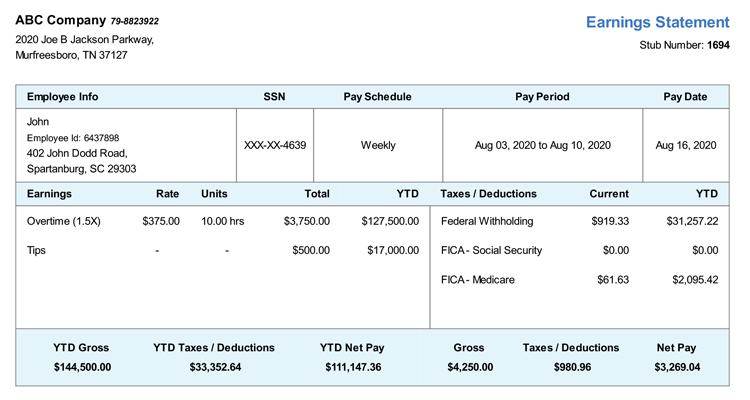

Before diving into the benefits of paycheck stub generators, let’s clarify what a paycheck stub is. A paycheck stub is a document that provides detailed information about an employee’s earnings for a specific pay period. It usually includes the gross pay, deductions (like taxes and insurance), and the net pay—the amount the employee takes home.

For employees, paycheck stubs serve as proof of income, helping them track their earnings and understand their financial situation better. For employers, providing accurate paycheck stubs is not just a best practice; it’s a legal requirement in many states.

Why Are Paycheck Stubs Important?

- Proof of Income: Employees often need paycheck stubs when applying for loans, renting an apartment, or for tax purposes. These documents validate their income.

- Tax Records: Paycheck stubs help employees keep track of their taxable income, making it easier to file taxes.

- Financial Management: Understanding their earnings helps employees budget better, plan for expenses, and save for the future.

- Legal Compliance: Employers are required to provide accurate pay stubs to their employees in many jurisdictions. This helps maintain transparency and trust within the workplace.

The Benefits of Using a Paycheck Stub Generator

For Employees

- Easy Access to Earnings Information: With a paycheck stub generator, employees can easily create their stubs whenever they need. This means no more waiting for the employer to provide information or worrying about lost stubs.

- Financial Clarity: Generating paycheck stubs allows employees to see a breakdown of their earnings and deductions. This transparency can help them identify areas where they might want to cut back or invest more.

- Better Budgeting: By regularly reviewing their paycheck stubs, employees can create more accurate budgets. They can see how much they earn and how much they spend, making it easier to plan for savings and expenses.

- Support for Loan Applications: When applying for loans or credit, having up-to-date paycheck stubs can streamline the process. They provide lenders with a clear picture of the applicant’s financial situation.

- Tax Preparation: At tax time, having organized paycheck stubs makes it easier to report income accurately. Employees can refer to their stubs to ensure they’re reporting the correct amounts.

For Employers

- Streamlined Payroll Process: A paycheck stub generator simplifies the payroll process for employers. Instead of manually creating stubs or using complicated software, they can generate them quickly and efficiently.

- Reduced Errors: Manual entry can lead to mistakes. Automated generators help minimize errors, ensuring that employees receive accurate information about their earnings.

- Compliance with Laws: As mentioned earlier, many states require employers to provide paycheck stubs. Using a generator helps ensure compliance with these laws, protecting the employer from potential legal issues.

- Professional Appearance: Providing well-organized, accurate paycheck stubs enhances the professionalism of a business. It shows employees that the employer values transparency and organization.

- Employee Trust and Satisfaction: When employers provide clear and accurate paycheck stubs, it builds trust. Employees appreciate knowing their pay details and understanding where their money goes.

Choosing the Right Paycheck Stub Generator

With so many options available, selecting the right paycheck stub generator can feel overwhelming. Here are some key factors to consider:

- User-Friendly Interface: Look for a generator that is easy to navigate. Employees and employers alike should be able to create stubs without extensive training.

- Customization Options: A good generator should allow customization. Employers may want to include their logo or specific company details on the stubs.

- Security Features: Given the sensitive nature of financial information, ensure that the generator has strong security measures in place to protect user data.

- Cost-Effective Solutions: Compare prices of different generators. Some may offer free trials or monthly subscriptions, so assess what fits your budget best.

- Customer Support: If issues arise, having access to customer support can be invaluable. Look for generators that offer prompt assistance to users.

How to Use a Paycheck Stub Generator

For Employees

- Gather Your Information: Before using a generator, gather all necessary information, including your gross pay, deductions, and the pay period dates.

- Select a Generator: Choose a user-friendly paycheck stub generator that meets your needs.

- Input Your Details: Follow the prompts to enter your information. Most generators will guide you through the process.

- Generate Your Stub: Once you’ve entered all the required details, generate your stub. Review it to ensure accuracy.

- Save and Print: Save a digital copy for your records and print a physical copy if needed.

For Employers

- Choose the Right Generator: Research and select a paycheck stub generator that suits your business needs.

- Input Company Details: Enter your company information, including the name, address, and any other relevant details.

- Collect Employee Information: Gather the necessary information for each employee, such as their name, pay rate, and deductions.

- Generate Paycheck Stubs: Input the employee information into the generator and create paycheck stubs for the payroll period.

- Distribute Stubs: Ensure employees receive their paycheck stubs promptly, either electronically or in printed form.

Conclusion

Whether you are an employee or an employer, a paycheck stub generator can significantly simplify financial management. For employees, it offers a clear picture of earnings and deductions, aiding in budgeting and tax preparation. For employers, it streamlines the payroll process, ensures compliance, and fosters employee trust.

Investing in a reliable paycheck stub generator can enhance financial clarity for both parties, creating a smoother, more efficient workplace. By understanding the importance of paycheck stubs and leveraging the right tools, you can make informed financial decisions that benefit everyone involved.

In the end, embracing technology like paycheck stub generators can pave the way for a brighter financial future, one paycheck at a time.