Payroll reporting can be a daunting task for businesses of all sizes. Whether you’re managing a small startup or overseeing a large company, keeping accurate records of employee payments is essential. One of the easiest ways to simplify the payroll reporting process is by using a free check stubs maker.

A check stubs maker is a tool that generates pay stubs for employees. It allows employers to produce detailed payment records that can be shared with workers, stored for reference, or used for tax and accounting purposes. If you’re new to using a check stub generator, this guide will walk you through the basics of how to use it effectively for payroll reporting.

Why You Need a Check Stub Maker

Before diving into how to use a check stubs maker, it’s important to understand why this tool is crucial for your payroll reporting needs.

- Accuracy: A check stub generator ensures that your pay stubs are accurate, as it automatically calculates things like tax deductions, overtime, and other withholdings.

- Time-Saving: Generating pay stubs manually can take a lot of time, especially if you’re dealing with a large workforce. A check stub maker can streamline the process and save you valuable hours.

- Compliance: Employers in the U.S. are required to keep detailed payroll records for tax purposes. Using a check stub maker ensures that you’re compliant with federal and state labor laws.

- Transparency: Employees appreciate transparency when it comes to their pay. By providing detailed pay stubs, you ensure that your workers understand how their pay is calculated.

Getting Started with a Check Stubs Maker

Now that you know why you need a check stub maker, let’s explore how to use one. Most check stub makers are online tools that allow you to generate pay stubs quickly and efficiently. Here’s how you can use them for payroll reporting:

1. Choose the Right Check Stub Maker

The first step in the process is selecting a check stub maker that fits your needs. Many options are available, so take your time to find one that offers the following features:

- Customizable Templates: Make sure the tool lets you customize the pay stub format to match your company’s branding.

- Accurate Calculations: Choose a generator that automatically calculates all necessary deductions, such as taxes, insurance, and retirement contributions.

- Easy-to-Use Interface: The tool should be easy to navigate, allowing you to enter payment details quickly.

- Security: Ensure that the website uses encryption to keep your payroll data secure.

2. Input Employee Information

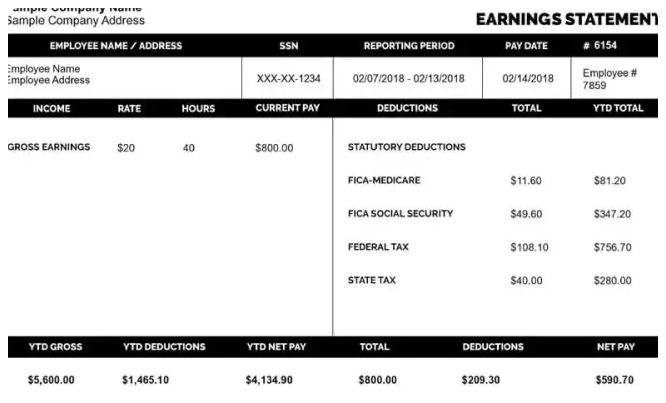

Once you’ve chosen your check stub maker, you’ll need to input employee information. Most generators will ask for basic details like:

- Employee Name: The name of the employee receiving the pay stub.

- Employee ID: If applicable, include a unique ID for each employee.

- Pay Period: Specify the start and end date for the pay period.

- Hourly Rate or Salary: Include the employee’s wage rate, whether hourly or salaried.

- Overtime: If applicable, enter any overtime hours worked by the employee.

- Bonuses and Commissions: If your employee is entitled to any additional payments, include those as well.

3. Enter Payroll Information

After entering the basic employee information, you will need to input the payroll details. The check stub maker will ask for information such as:

- Gross Pay: The total amount earned by the employee before deductions.

- Deductions: This includes federal and state taxes, Social Security, Medicare, insurance premiums, and retirement contributions.

- Net Pay: The amount the employee will take home after all deductions are subtracted.

Some check stub makers allow you to integrate with your existing payroll software or accounting systems, which can automate the process and reduce the risk of errors.

4. Review and Customize the Pay Stub

Before generating the pay stub, it’s important to review the details carefully. Double-check the figures, especially when it comes to deductions and bonuses. Most check stub makers allow you to customize the pay stub layout, including:

- Company Logo: Add your company’s logo for a professional look.

- Additional Notes: Include any specific notes or messages, such as reminders about upcoming holidays or tax deadlines.

- Custom Fields: If your business requires additional information (like specific tax codes or commission rates), make sure the check stub maker can accommodate those.

5. Generate and Distribute Pay Stubs

Once you’re satisfied with the pay stub details, it’s time to generate the pay stub. The check stub maker will create a document that you can download in PDF format or email directly to the employee. Some tools also let you print the pay stub for physical distribution.

It’s important to keep copies of the pay stubs for your records. Most check stub makers store a history of generated pay stubs, allowing you to retrieve them later if needed for audits or tax purposes.

Best Practices for Payroll Reporting with a Check Stub Maker

Using a check stub maker can greatly improve your payroll reporting, but it’s important to follow best practices to ensure the process runs smoothly.

1. Stay Consistent

Make sure you consistently use the same check stubs maker for all employees. This will help maintain uniformity across your payroll system and ensure that the pay stubs are accurate every time.

2. Double-Check Everything

Even though a check stub maker can handle calculations automatically, it’s still a good idea to double-check all the details before finalizing the pay stubs. A simple typo or oversight could lead to errors in tax calculations or deductions.

3. Communicate with Employees

Make sure your employees understand how to read their pay stubs. Some employees may not know what certain deductions mean or how their net pay is calculated. Provide guidance or a breakdown of their pay stub if necessary.

4. Keep Records Organized

It’s important to keep both digital and physical copies of all generated pay stubs. Organize them by pay period and employee to make it easy to retrieve them when needed. Many check stub makers offer cloud storage options, making it easy to access past pay stubs from any device.

Conclusion

A check stub maker is an invaluable tool for businesses looking to simplify payroll reporting. It saves time, ensures accuracy, and helps maintain compliance with payroll regulations. By following the steps outlined above and adhering to best practices, you can create detailed pay stubs that benefit both your business and your employees.

By choosing the right check stubs maker, inputting the correct information, reviewing the pay stub for accuracy, and distributing them on time, you’ll have a smooth and efficient payroll system in place. This will ultimately lead to a more satisfied workforce and a well-managed business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary