As a business owner, managing payroll is one of the most crucial responsibilities you have. However, it can also be one of the most time-consuming and error-prone tasks. Whether you have a few employees or hundreds, the process of calculating salaries, deductions, and taxes can be complex. Payroll mistakes can lead to unhappy employees, legal issues, and fines. To ease this burden, many businesses are turning to a free paycheck creator to streamline their payroll process.

In this blog, we’ll discuss the cost-efficiency of using a paycheck creator and how it can benefit your business. We’ll also explore how these tools can save you time, reduce errors, and improve accuracy, all while helping your business stay compliant with regulations. If you’re considering using a paycheck creator for your business, this article will help you understand why it’s an excellent choice for both small and large enterprises.

What Is a Paycheck Creator?

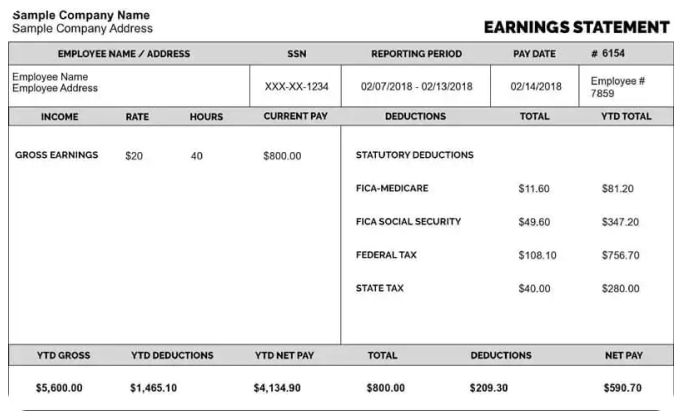

A paycheck creator is an online tool or software that helps businesses generate accurate paychecks for their employees. These tools take into account factors such as hourly rates, salaries, tax deductions, benefits, and other withholdings to calculate the exact amount employees should receive. Paycheck creators are easy to use and designed to save you the hassle of manual payroll calculations.

For small businesses, using a free paycheck creator can be a lifesaver, especially if you’re looking to avoid the high costs associated with hiring an accountant or payroll service.

Why Use a Paycheck Creator?

1. Accuracy and Error Reduction

When it comes to payroll, accuracy is key. A single mistake can cause significant problems for both your business and your employees. Incorrect paychecks can lead to frustrated workers, compliance issues, and even legal action in some cases. Using a paycheck creator significantly reduces the likelihood of errors.

These tools automatically calculate deductions, taxes, and other contributions based on the latest IRS guidelines and state laws. This means you won’t have to worry about manually applying the correct tax rates or forgetting to deduct the right amount. The result? Employees receive their correct pay on time, and your business avoids any costly mistakes.

2. Time-Saving Convenience

For small business owners, time is always in short supply. Payroll can take hours, especially if you have multiple employees with varying pay rates, overtime, or bonuses. A paycheck creator simplifies this process by allowing you to generate paychecks in minutes. All you need to do is input the necessary information (e.g., hours worked, salary, bonuses), and the tool will do the rest.

This means you can spend more time focusing on other important areas of your business, like customer service, marketing, and growth, instead of getting bogged down by tedious administrative tasks.

3. Cost-Effective Solution

One of the biggest advantages of using a paycheck creator is its cost-efficiency. Traditional payroll services often charge businesses based on the number of employees or the complexity of the payroll system. These fees can quickly add up, especially for small businesses with limited budgets.

With a free paycheck creator, you can save money by handling payroll in-house without the need for external help. Even if you’re paying for a premium version, these tools are usually much more affordable than hiring a payroll service or accountant. This gives you the flexibility to allocate your resources to other areas of your business.

4. Improved Compliance

Payroll is a complex area, and staying compliant with tax laws and employment regulations can be a challenge. From federal taxes to state-specific regulations, there are many rules to keep track of. A paycheck creator can help you stay compliant by automatically applying the right tax rates and ensuring that all deductions are made correctly.

For instance, if your state has a specific tax rate for employees, the paycheck creator will apply that rate without you needing to look up the information. Many paycheck creators are also regularly updated to reflect the latest changes in tax laws, so you can be confident that your payroll is always compliant with the most current standards.

5. Scalability for Growing Businesses

As your business grows, managing payroll can become increasingly complex. If you start with just a few employees but eventually hire more, a paycheck creator can scale with you. Whether you have 5 employees or 50, the tool can handle the increase in complexity without requiring additional resources or extra staff.

Scalability is a key benefit for businesses that expect to grow over time. With a paycheck creator, you won’t have to worry about outgrowing your payroll solution. You can continue using the tool as your company expands, adjusting the settings as necessary to accommodate your growing workforce.

How Does a Free Paycheck Creator Help Your Business?

1. No Hidden Costs

One of the main reasons businesses choose free paycheck creators is that they don’t have to worry about hidden fees or long-term commitments. Many traditional payroll services charge based on the number of employees, the frequency of payroll runs, or additional features like tax filing. A free paycheck creator allows you to generate paychecks without these added expenses.

Even if you choose a paid version with more features, the cost is usually much lower compared to other payroll solutions. Many free tools offer the option to upgrade for advanced features like automatic tax filing or reports, making them a flexible and affordable choice for businesses.

2. User-Friendly Interface

You don’t need to be an accounting expert to use a paycheck creator. These tools are designed with simplicity in mind, making them accessible to business owners without a background in finance. The intuitive interfaces guide you step-by-step through the process, so you don’t need to worry about complicated calculations or software.

Most paycheck creators are also cloud-based, meaning you can access them from anywhere and on any device. This level of flexibility allows you to manage payroll on the go, even if you’re not at your office.

3. Customizable Pay Schedules

Every business has different payroll needs. Some businesses pay their employees weekly, others bi-weekly, and some monthly. A paycheck creator lets you choose the pay schedule that works best for your business, ensuring that employees are paid on time and that your payroll process remains consistent.

You can also set up recurring paychecks for employees with fixed salaries, further streamlining the process and reducing the time spent on payroll management each pay period.

4. Tax Filing Assistance

Filing taxes can be one of the most stressful aspects of managing payroll. With a paycheck creator, some tools offer built-in features that help you track and file your taxes correctly. These tools can calculate the correct amount of federal and state taxes to deduct from each paycheck and offer reports that help you with year-end tax filing.

Some paycheck creators also integrate with tax filing software, ensuring that your tax filing process is seamless and free from errors.

Choosing the Right Paycheck Creator for Your Business

When selecting a free paycheck creator, there are several factors to consider:

- Ease of Use: Make sure the tool has an intuitive interface and is easy to navigate.

- Features: Look for features that meet your business’s needs, such as customizable pay schedules, tax filing assistance, and the ability to handle deductions.

- Scalability: Choose a tool that can grow with your business, allowing you to easily manage payroll as your workforce expands.

- Customer Support: Ensure the paycheck creator offers reliable customer support in case you need assistance.

- Security: Since payroll involves sensitive financial information, it’s important to choose a tool with strong security measures in place.

Conclusion

Managing payroll is an essential part of running any business, but it doesn’t have to be complicated or expensive. By using a free paycheck creator, you can save time, reduce errors, stay compliant, and improve your overall payroll process—all without breaking the bank. Whether you’re a small business owner just starting out or a growing company looking for an affordable solution, a paycheck creator can be the perfect tool to streamline your payroll process and ensure that your employees are paid accurately and on time.

The cost-efficiency, ease of use, and scalability of paycheck creators make them an ideal choice for businesses of all sizes. By adopting this technology, you’ll not only simplify your administrative workload but also create a more efficient and effective payroll system for the future.

So, if you’re ready to take control of your payroll process, consider giving a paycheck creator a try. It might be the best decision you make for your business’s success.