When running a small business or freelancing, managing payroll efficiently is essential. One of the most crucial aspects of payroll is creating accurate and professional paychecks for employees and contractors. Paychecks are not just a way to compensate workers—they are a reflection of your business’s professionalism and attention to detail. Fortunately, you don’t have to spend a fortune to generate custom paychecks. With the help of free paycheck creators, you can create personalized, professional paychecks that comply with tax regulations and provide all necessary details to your employees.

In this blog, we will guide you through the process of creating custom paychecks, share tips on how to make them effective, and review some of the best free paycheck creator tools available for small business owners, freelancers, and startups.

Why Customize Your Paychecks?

Customizing your paychecks is essential for several reasons. While it may seem like a small detail, it can significantly impact your business’s credibility and efficiency. Here are some reasons why creating custom paychecks is important:

-

Professionalism: Customized paychecks with your company’s logo, branding, and employee details help maintain a professional image. A well-designed paycheck shows employees that you take their compensation seriously.

-

Legal Compliance: Paychecks must include specific information to comply with tax laws. These include federal and state tax deductions, employee benefits, and overtime calculations. Customizing your paychecks ensures that these legal requirements are met.

-

Transparency: Custom paychecks help employees understand how their pay was calculated, including any deductions, bonuses, or overtime pay. Transparency fosters trust and reduces confusion.

-

Tracking: Customized paychecks make it easier to track payments, deductions, and benefits for your employees and contractors. This helps ensure accurate records for both tax reporting and future reference.

Tips for Creating Custom Paychecks

Before we dive into the tools available, let’s go over some practical tips for creating effective custom paychecks:

-

Include Essential Information

- Company Name and Logo: Your paychecks should reflect your business identity. Include your company’s name, logo, and address to make the paycheck official.

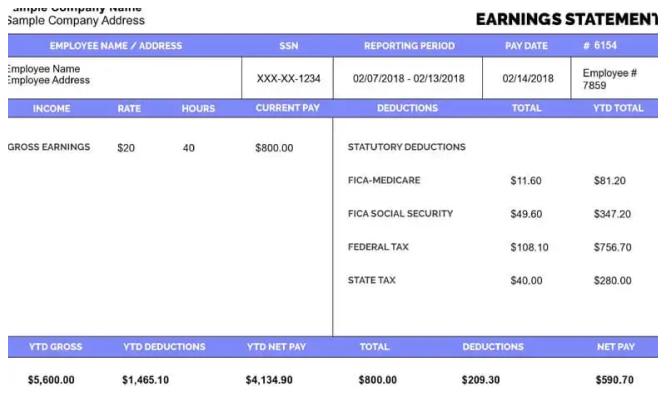

- Employee Details: Every paycheck should have the employee’s name, job title, and the pay period dates. This ensures that both parties know the exact period being paid for.

- Earnings Breakdown: Provide a detailed breakdown of earnings, including regular wages, overtime, bonuses, and commissions if applicable.

- Deductions: Include all deductions such as federal and state taxes, health insurance, retirement contributions, and other benefits.

- Net Pay: Clearly highlight the employee’s net pay (the amount they take home after deductions).

-

Calculate Taxes Correctly Make sure that the correct tax deductions are applied based on the employee’s state and federal tax rates. The IRS provides a standard set of tax rates, but state and local taxes may vary. Many free paycheck creators come with tax calculators that can help ensure your calculations are accurate.

-

Offer Direct Deposit Options Although many free paycheck creators are designed to print paper paychecks, offering direct deposit is a great convenience for employees. Some tools include direct deposit features for a small fee, which can save you time and postage costs.

-

Review Before Sending Before issuing paychecks, always double-check the calculations. Ensure that all deductions are applied correctly, and that the net pay matches the employee’s expectations.

-

Ensure Compliance with Local, State, and Federal Regulations Keep up to date with tax laws and compliance requirements in your area. Paychecks must meet federal and state regulations regarding tax withholdings, benefit contributions, and overtime pay. Many free tools offer features to help with these regulations.

Best Free Paycheck Creators for Small Business Owners

Now, let’s explore some of the best free paycheck creator tools that can help you create custom paychecks quickly and easily.

1. Wave Payroll

Wave Payroll offers both free and paid payroll services. The free version of Wave Payroll allows small business owners to generate paychecks for up to one employee, which makes it perfect for freelancers or very small businesses.

Features:

- Free for businesses with one employee.

- Easy-to-use interface for paycheck creation.

- Automatic tax calculations (federal and state).

- Can be upgraded to handle more employees with additional features.

- Integrates with other Wave financial tools for seamless management.

Pros:

- Simple and intuitive design.

- Free for businesses with one employee.

- Tax calculations included.

Cons:

- Free version only works for one employee.

- Limited advanced features for larger businesses.

Best for: Freelancers or small businesses with a single employee looking for a basic paycheck creator.

2. PaycheckCity

PaycheckCity is a great tool for generating free paychecks with accurate tax calculations. It provides a simple online paycheck stub generator with no sign-up required.

Features:

- Free paycheck stub creator.

- Customizable pay stubs with detailed earnings, taxes, and deductions.

- Calculates federal, state, and local taxes.

- No account required for basic use.

- Allows you to print or save the pay stub as a PDF.

Pros:

- Easy to use with a clean interface.

- Supports tax calculations for multiple states.

- No registration required.

Cons:

- Lacks advanced payroll features like direct deposit.

- Some features require paid versions (e.g., advanced reports).

Best for: Small business owners who need a simple, free paycheck creator without needing additional payroll services.

3. Payroll4Free

Payroll4Free provides a comprehensive free payroll solution for small businesses with fewer than 25 employees. The free version includes everything needed to generate custom paychecks, including tax calculations and reporting.

Features:

- Free payroll and paycheck creation for businesses with up to 25 employees.

- Generates pay stubs, tax reports, and direct deposit (for a small fee).

- Tracks employee hours, vacation, and overtime.

- Helps you file taxes and maintain payroll records.

Pros:

- Free for businesses with up to 25 employees.

- Includes tax calculations and direct deposit options (for a fee).

- Generates detailed reports and pay stubs.

Cons:

- Limited to 25 employees on the free plan.

- Direct deposit requires a paid plan.

Best for: Small businesses with fewer than 25 employees looking for an all-in-one payroll solution.

4. Check Stub Maker

Check Stub Maker is another simple tool for generating pay stubs and paycheck records. While it doesn’t offer full payroll processing, it’s an excellent tool for creating customized pay stubs once payroll calculations are done.

Features:

- Free pay stub generator.

- Customizable pay stubs with deductions, overtime, and benefits.

- Allows you to save and print pay stubs.

- Provides a professional, easy-to-read format.

Pros:

- Very user-friendly.

- No need for an account or subscription.

- Customizable pay stubs.

Cons:

- Does not handle payroll tax calculations or direct deposit.

- Limited to pay stub creation; no full payroll service.

Best for: Freelancers and businesses that need to generate pay stubs after completing payroll calculations manually or through other software.

5. Intuit QuickBooks Payroll (Free Trial)

While QuickBooks Payroll is generally a paid service, it does offer a free trial, which can be used to create paychecks and explore payroll features for a limited time. QuickBooks is a well-known name in accounting, and its payroll software integrates with its accounting tools for seamless business management.

Features:

- Free trial for payroll services.

- Full payroll services, including paycheck creation, tax calculations, and reports.

- Integration with QuickBooks accounting software.

- Employee benefits and deductions management.

Pros:

- Comprehensive payroll features.

- Excellent integration with QuickBooks accounting.

- Offers tax filing and reporting.

Cons:

- After the trial, you need to subscribe to the paid version.

- More suited for larger businesses that need full payroll processing.

Best for: Small businesses already using QuickBooks for accounting or those who need more robust payroll features.

Conclusion

Creating custom paychecks is essential for ensuring that your employees are paid accurately and on time. Whether you’re a small business owner or a freelancer, using a free paycheck creator can save you both time and money. By choosing one of the tools mentioned in this blog, you can simplify the payroll process and ensure that your paychecks are professional, compliant, and easy to understand.

When selecting the right free paycheck creator, make sure to consider your business size, the features you need, and the ease of use. With the right tool, you can take control of your payroll, reduce the risk of errors, and focus on growing your business.